Sunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 1,900 shares of $50 par value preferred stock and 108,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $5,200; 2022, $14,200; and 2023, $27,000. (a) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 6% and noncumulative. Allocation to preferred stock $ Allocation to common stock $ 2021 $ $ 2022 $ $ 2023

Sunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 1,900 shares of $50 par value preferred stock and 108,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $5,200; 2022, $14,200; and 2023, $27,000. (a) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 6% and noncumulative. Allocation to preferred stock $ Allocation to common stock $ 2021 $ $ 2022 $ $ 2023

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

![### Sunland Corporation Dividend Allocation Explanation

**Background Information:**

Sunland Corporation was established on January 1, 2021. Within its inaugural year, the corporation issued the following stocks:

- **Preferred Stock:** 1,900 shares with a par value of $50 each.

- **Common Stock:** 108,000 shares with a par value of $10 each.

The cash dividends declared by the corporation at the end of each year are as follows:

- **2021:** $5,200

- **2022:** $14,200

- **2023:** $27,000

**Dividend Allocation Task:**

The task is to allocate dividends to each class of stock. The preferred stock carries a 6% dividend rate and is noncumulative.

**Allocation of Dividends:**

- **Preferred Stock Calculation:**

- **Dividend Rate:** 6%

- **Par Value per Share:** $50

- **Number of Shares:** 1,900

The annual dividend for preferred stock is calculated as:

\[

\text{Annual Dividend} = \text{Dividend Rate} \times \text{Number of Shares} \times \text{Par Value}

\]

\[

= 0.06 \times 1,900 \times 50

\]

\[

= \$5,700

\]

- **Common Stock Calculation:**

Total dividend declared minus the preferred stock dividend gives the remaining amount for common stock.

**Table of Allocations:**

| Year | Allocation to Preferred Stock | Allocation to Common Stock |

|------|-------------------------------|----------------------------|

| 2021 | $5,200 | $0 |

| 2022 | $5,700 | $8,500 |

| 2023 | $5,700 | $21,300 |

**Explanation of Allocation:**

- **2021:** The total available dividend of $5,200 is less than the required $5,700 for preferred stock; hence all $5,200 goes to preferred stock.

- **2022:** A full dividend of $5,700 is paid to preferred stock, with the remainder ($14,200 - $5,700 = $8,500) paid to common stock.

- **2023:** A full dividend of $5,700 is again paid to preferred stock, with the](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fe30699be-2882-4a27-acce-afcc593a9b43%2F50e8fa26-a062-42b0-8315-77ef4acb4982%2Fkzkn4td_processed.png&w=3840&q=75)

Transcribed Image Text:### Sunland Corporation Dividend Allocation Explanation

**Background Information:**

Sunland Corporation was established on January 1, 2021. Within its inaugural year, the corporation issued the following stocks:

- **Preferred Stock:** 1,900 shares with a par value of $50 each.

- **Common Stock:** 108,000 shares with a par value of $10 each.

The cash dividends declared by the corporation at the end of each year are as follows:

- **2021:** $5,200

- **2022:** $14,200

- **2023:** $27,000

**Dividend Allocation Task:**

The task is to allocate dividends to each class of stock. The preferred stock carries a 6% dividend rate and is noncumulative.

**Allocation of Dividends:**

- **Preferred Stock Calculation:**

- **Dividend Rate:** 6%

- **Par Value per Share:** $50

- **Number of Shares:** 1,900

The annual dividend for preferred stock is calculated as:

\[

\text{Annual Dividend} = \text{Dividend Rate} \times \text{Number of Shares} \times \text{Par Value}

\]

\[

= 0.06 \times 1,900 \times 50

\]

\[

= \$5,700

\]

- **Common Stock Calculation:**

Total dividend declared minus the preferred stock dividend gives the remaining amount for common stock.

**Table of Allocations:**

| Year | Allocation to Preferred Stock | Allocation to Common Stock |

|------|-------------------------------|----------------------------|

| 2021 | $5,200 | $0 |

| 2022 | $5,700 | $8,500 |

| 2023 | $5,700 | $21,300 |

**Explanation of Allocation:**

- **2021:** The total available dividend of $5,200 is less than the required $5,700 for preferred stock; hence all $5,200 goes to preferred stock.

- **2022:** A full dividend of $5,700 is paid to preferred stock, with the remainder ($14,200 - $5,700 = $8,500) paid to common stock.

- **2023:** A full dividend of $5,700 is again paid to preferred stock, with the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

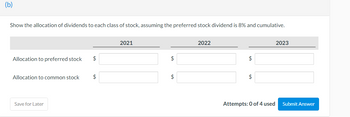

Transcribed Image Text:In this educational activity, you'll demonstrate the allocation of dividends to each class of stock. Given that the preferred stock dividend is 8% and cumulative, you'll distribute the dividends across the years 2021, 2022, and 2023.

To complete the exercise, fill in the dollar amounts for the allocation to preferred stock and common stock for each year. The dividend distribution framework is presented in a tabular format:

- **2021**: Enter amounts for both preferred and common stock.

- **2022**: Enter amounts for both preferred and common stock.

- **2023**: Enter amounts for both preferred and common stock.

At the bottom of the table, you have the option to "Save for Later" to return to your work. Monitor your progress with "Attempts: 0 of 4 used," and submit your answer when ready by clicking the "Submit Answer" button.

Solution

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education