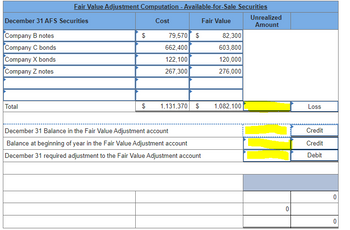

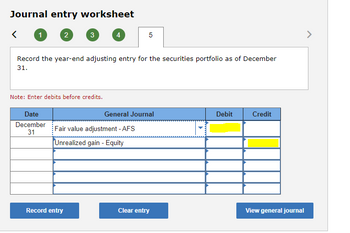

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Cost Fair Value Company A bonds $ 534,100 $ 492,000 Company B notes 159,140 155,000 Company C bonds 662,400 642,140 Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,820. July 6 Purchased Company X bonds for $122,100. November 13 Purchased Company Z notes for $267,300. December 9 Sold all of the Company A bonds for $524,800. Fair values at December 31 are B, $82,300; C, $603,800; X, $120,000; and Z, $276,000. Problem 15-3A (Algo) Part 1 and 2 Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities. 2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following.

| Available-for-Sale Securities | Cost | Fair Value |

|---|---|---|

| Company A bonds | $ 534,100 | $ 492,000 |

| Company B notes | 159,140 | 155,000 |

| Company C bonds | 662,400 | 642,140 |

Stoll enters into the following transactions involving its available-for-sale debt securities this year.

| January 29 | Sold one-half of the Company B notes for $78,820. |

|---|---|

| July 6 | Purchased Company X bonds for $122,100. |

| November 13 | Purchased Company Z notes for $267,300. |

| December 9 | Sold all of the Company A bonds for $524,800. |

Fair values at December 31 are B, $82,300; C, $603,800; X, $120,000; and Z, $276,000.

Problem 15-3A (Algo) Part 1 and 2

Required:

1. Prepare

2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Can you please assist with the highlighted sections? I used the formulas provided and still can not figure these out.