Starting on the day he retires, Bob wants to receive payments of $10,000 at the beginning of each quarter for 20 years. How much money should he deposit each quarter starting today if he plans to retire in 35 years and he makes his last deposit 5.25 years (i.e., 5 years and 3 months) before his retirement date? Assume that the account earns a nominal rate of 7% per year compounded quarterly for the first 35 years and then a nominal rate of 5% per year compounded quarterly thereafter. Round to 2 decimal places.

Starting on the day he retires, Bob wants to receive payments of $10,000 at the beginning of each quarter for 20 years. How much money should he deposit each quarter starting today if he plans to retire in 35 years and he makes his last deposit 5.25 years (i.e., 5 years and 3 months) before his retirement date? Assume that the account earns a nominal rate of 7% per year compounded quarterly for the first 35 years and then a nominal rate of 5% per year compounded quarterly thereafter. Round to 2 decimal places.

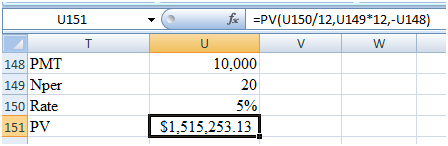

Present value of the amount is the worth of that amount in current times that is expected to be received in some future date at given interest rate.

Given Information:

Amount required at each quarter for 20 years is $10,000

Nominal interest rate for first 35 years is 7% (quarterly compounded)

Nominal interest rate after 35 years is 5% (quarterly compounded)

Calculations:

Step by step

Solved in 5 steps with 2 images