ABC Corporation, a public company, is a consulting services organization and started business on January 1, 2020. You are a CPA for ABC Corporation hired December 1, 2020. The prior CPA who was fired had correct balances in the ledger as confirmed by PwC but intentionally put dollars in wrong columns of the November 30, 2020 Unadjusted Trial Balance. Begin this Project by first preparing a CORRECTED & BALANCED Unadjusted Trial Balance for November 30, 2020 from the attached INCORRECT & UNBALANCED Unadjusted Trial Balance for November 30, 2020. START LEDGER!!! HINT: Review Page 61 Illustration 2-9 Unadjusted Trial Balance Next, during December, the last month of operation for the calendar year, the following internal and external transactions occurred for the month. Analyze these transactions, record the transactions in the Journal, post to the Ledger, and prepare an Unadjusted Trial Balance for December 31, 2020. 12/1/20: Issued additional $3,000,000 Common Stock 12/1/20: Purchased Supplies from Office Max for $30,000 on Account 12/10/20: Provided Services for $500,000 Cash 12/15/20: Provided Services for $400,000 on Account 12/15/20: Paid Account Payable of $10,000 from the above transaction 12/22/20: Provided Services for $100,000 on Account 12/31/20: Paid Utilities of $20,000 for December 12/31/20: Paid Advertising of $10,000 for December 12/31/20: Paid Salaries of $100,000 for December 12/31/20: Paid Dividend of $50,000 12/31/20: ABC received $100,000 for a service to be performed during January,2021

ABC Corporation, a public company, is a consulting services organization and started business on January 1, 2020. You are a CPA for ABC Corporation hired December 1, 2020. The prior CPA who was fired had correct balances in the ledger as confirmed by PwC but intentionally put dollars in wrong columns of the November 30, 2020 Unadjusted Trial Balance. Begin this Project by first preparing a CORRECTED & BALANCED Unadjusted Trial Balance for November 30, 2020 from the attached INCORRECT & UNBALANCED Unadjusted Trial Balance for November 30, 2020. START LEDGER!!! HINT: Review Page 61 Illustration 2-9 Unadjusted Trial Balance Next, during December, the last month of operation for the calendar year, the following internal and external transactions occurred for the month. Analyze these transactions, record the transactions in the Journal, post to the Ledger, and prepare an Unadjusted Trial Balance for December 31, 2020. 12/1/20: Issued additional $3,000,000 Common Stock 12/1/20: Purchased Supplies from Office Max for $30,000 on Account 12/10/20: Provided Services for $500,000 Cash 12/15/20: Provided Services for $400,000 on Account 12/15/20: Paid Account Payable of $10,000 from the above transaction 12/22/20: Provided Services for $100,000 on Account 12/31/20: Paid Utilities of $20,000 for December 12/31/20: Paid Advertising of $10,000 for December 12/31/20: Paid Salaries of $100,000 for December 12/31/20: Paid Dividend of $50,000 12/31/20: ABC received $100,000 for a service to be performed during January,2021

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:**ABC Corporation Unadjusted Trial Balance Project**

**Project Overview:**

ABC Corporation is a consulting services organization that began operations on January 1, 2020. You are hired as a CPA for ABC Corporation starting December 1, 2020. The previous CPA made errors by misplacing dollar amounts in the November 30, 2020 Unadjusted Trial Balance. Your task is to prepare a CORRECTED & BALANCED Unadjusted Trial Balance for November 30, 2020, using the incorrect and unbalanced trial balance provided.

**Instructions:**

- Review Page 61 Illustration 2-9 Unadjusted Trial Balance.

- Record and analyze internal and external transactions for December 2020.

- Post transactions to the Journal and prepare an Unadjusted Trial Balance for December 31, 2020.

**Transactions During December:**

- **12/1/20:** Issued $3,000,000 of Common Stock.

- **12/1/20:** Purchased Supplies from Office Max for $30,000 on Account.

- **12/10/20:** Provided Services for $500,000 Cash.

- **12/15/20:** Provided Services for $400,000 on Account.

- **12/15/20:** Paid Account Payable of $10,000 from the above transaction.

- **12/20/20:** Provided Services for $100,000 on Account.

- **12/31/20:** Paid Utilities of $20,000 for December.

- **12/31/20:** Paid Advertising $10,000 for December.

- **12/31/20:** Paid Salaries of $100,000 for December.

- **12/31/20:** Paid Dividend of $50,000.

- **12/31/20:** ABC received $100,000 for a service to be performed during January 2021.

Ensure all transactions are accurately recorded and that the trial balance reflects the corrected values.

Transcribed Image Text:**ABC Corporation**

**Unadjusted Trial Balance**

**November 30, 2020**

| **Account Title** | **Debits** | **Credits** |

|--------------------------|----------------|----------------|

| Cash | | $2,340,000 |

| Rent Expense | $60,000 | |

| Sales Revenue | | $5,000,000 |

| Notes Payable | | $200,000 |

| Common Stock | $1,000,000 | |

| Supplies | $20,000 | |

| Utilities Expense | $220,000 | |

| Dividend | $50,000 | |

| Dividend Payable | | $50,000 |

| Salary Expense | $1,100,000 | |

| Office Equipment | $62,000 | |

| Advertising Expense | $110,000 | |

| Prepaid Insurance | $288,000 | |

| Accounts Receivable | $2,000,000 | |

| **TOTALS** | $7,322,000 | $5,178,000 |

This trial balance for ABC Corporation as of November 30, 2020, shows all the debit and credit balances of the accounts before any adjustments are made. The accounts are listed with their corresponding debit or credit values, ensuring that the total debits equal the total credits, a fundamental principle in accounting to ensure that transactions are accurately recorded.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Could you show the adjusted

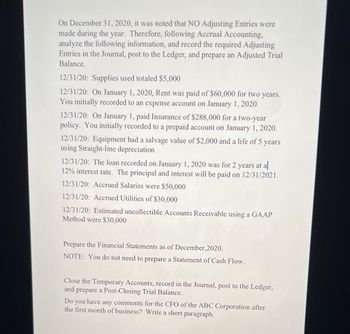

Transcribed Image Text:On December 31, 2020, it was noted that NO Adjusting Entries were made during the year. Therefore, following Accrual Accounting, analyze the following information, and record the required Adjusting Entries in the Journal, post to the Ledger, and prepare an Adjusted Trial Balance.

12/31/20: Supplies used totaled $5,000

12/31/20: On January 1, 2020, Rent was paid of $60,000 for two years. You initially recorded to an expense account on January 1, 2020.

12/31/20: On January 1, paid Insurance of $288,000 for a two-year policy. You initially recorded to a prepaid account on January 1, 2020.

12/31/20: Equipment had a salvage value of $2,000 and a life of 5 years using Straight-line depreciation

12/31/20: The loan recorded on January 1, 2020 was for 2 years at a 12% interest rate. The principal and interest will be paid on 12/31/2021.

12/31/20: Accrued Salaries were $50,000

12/31/20: Accrued Utilities of $30,000

12/31/20: Estimated uncollectible Accounts Receivable using a GAAP Method were $30,000

Prepare the Financial Statements as of December, 2020.

NOTE: You do not need to prepare a Statement of Cash Flow.

Close the Temporary Accounts, record in the Journal, post to the Ledger, and prepare a Post-Closing Trial Balance.

Do you have any comments for the CFO of the ABC Corporation after the first month of business? Write a short paragraph.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education