-33 Robertson Resorts is considering whether to expand its Pagosa Springs Lodge. The expansion will create 24 additional rooms for rent. The following estimates are available Cost of expansion Discount rate Useful life Annual rental income $ 2,050,000 Annual operating expenses $ 1,600,000 Robertson uses straight-line depreciation and the lodge expansion will have a residual value $2,640,000. Required: 1. Calculate the annual net operating income from the expansion. 2. Calculate the annual net cash inflow from the expansion. 3. Calculate the ARR. Note: Round your answer to 2 decimal places. 4. Calculate the payback period. 1 Annual Operating Income 2. Annual Net Cash Inflow 3 ARR $ 3,220,000 4. Payback Period 5 NPV Note: Round your answer to 1 decimal place. 5. Calculate the NPV (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round your final answer to nearest whole dollar amount. 98 years 20

-33 Robertson Resorts is considering whether to expand its Pagosa Springs Lodge. The expansion will create 24 additional rooms for rent. The following estimates are available Cost of expansion Discount rate Useful life Annual rental income $ 2,050,000 Annual operating expenses $ 1,600,000 Robertson uses straight-line depreciation and the lodge expansion will have a residual value $2,640,000. Required: 1. Calculate the annual net operating income from the expansion. 2. Calculate the annual net cash inflow from the expansion. 3. Calculate the ARR. Note: Round your answer to 2 decimal places. 4. Calculate the payback period. 1 Annual Operating Income 2. Annual Net Cash Inflow 3 ARR $ 3,220,000 4. Payback Period 5 NPV Note: Round your answer to 1 decimal place. 5. Calculate the NPV (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round your final answer to nearest whole dollar amount. 98 years 20

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. table is not given Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Subject: accounting

Transcribed Image Text:-33

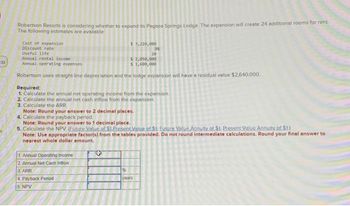

Robertson Resorts is considering whether to expand its Pagosa Springs Lodge. The expansion will create 24 additional rooms for rent.

The following estimates are available

Cost of expansion

Discount rate

Useful life

Annual rental income

$ 2,050,000

Annual operating expenses

$ 1,600,000

Robertson uses straight-line depreciation and the lodge expansion will have a residual value $2,640,000.

Required:

1. Calculate the annual net operating income from the expansion.

2. Calculate the annual net cash inflow from the expansion.

3. Calculate the ARR.

Note: Round your answer to 2 decimal places.

4. Calculate the payback period.

1 Annual Operating Income

2. Annual Net Cash Inflow

3 ARR

$ 3,220,000

4. Payback Period

5 NPV

Note: Round your answer to 1 decimal place.

5. Calculate the NPV (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1)

Note: Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Round your final answer to

nearest whole dollar amount.

98

years

20

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT