Retained earnings and balance sheet data: Accounts payable Accounts receivable Accumulated depreciation-office buildings and equipment Accumulated depreciation-store buildings and equipment Allowance for doubtful accounts Bonds payable, 5%, due in 10 years Cash Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding), January 1, 20Y8 Dividends: $194,300 545,000 1,580,000 4,126,000 8,450 500,000 282,850 1,700,000

Retained earnings and balance sheet data: Accounts payable Accounts receivable Accumulated depreciation-office buildings and equipment Accumulated depreciation-store buildings and equipment Allowance for doubtful accounts Bonds payable, 5%, due in 10 years Cash Common stock, $20 par (400,000 shares authorized; 85,000 shares issued, 94,600 outstanding), January 1, 20Y8 Dividends: $194,300 545,000 1,580,000 4,126,000 8,450 500,000 282,850 1,700,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Retained earnings and balance sheet data:

Accounts payable

Accounts receivable

Accumulated depreciation-office buildings and equipment

Accumulated depreciation-store buildings and equipment

Allowance for doubtful accounts

Bonds payable, 5%, due in 10 years

Cash

Common stock, $20 par (400,000 shares authorized;

85,000 shares issued, 94,600 outstanding), January 1, 20Y8

Dividends:

Sales

$194,300

545,000

1,580,000

4,126,000

Operating oxpopcos:

8,450

500,000

282,850

Cash dividends for common stock

Cash dividends for preferred stock

Goodwill

Income tax payable

Interest receivable

Inventory (December 31, 20Y8), at lower of cost (FIFO) or market

Office buildings and equipment

Paid-in capital from sale of treasury stock, January 1, 2018

Paid-in capital in excess of par-common stock, January 1, 20Y8

Paid-in capital in excess of par-preferred stock, January 1, 20Y8

Preferred 5% stock, $80 par (30,000 shares authorized;

16,000 shares issued), January 1, 20Y8

Premium on bonds payable

Prepaid expenses

Retained earnings, January 1, 20Y8

Store buildings and equipment

Treasury stock, January 1, 20Y8

a. Prepare a multiple-step income statement for the year ended December 31, 20Y8.

Equinox Products Inc.

Income Statement

For the Year Ended December 31, 20Y8

1,700,000

155,120

100,000

700,000

44,000

1,200

778,000

4,320,000

736,800

70,000

0

1,280,000

19,000

27,400

8,197,220

12,560,000

$

$

0

Transcribed Image Text:Income statement data:

Advertising expense

Cost of goods sold

Delivery expense

Depreciation expense-office buildings and equipment

Depreciation expense-store buildings and equipment

Income tax expense

Interest expense

Interest revenue

Miscellaneous administrative expense

Miscellaneous selling expense

Office rent expense

Office salaries expense

Office supplies expense

Sales

Sales commissions

Sales salaries expense

Store supplies expense

Retained earnings and balance sheet data:

Accounts payable

Accounts receivable

Accumulated depreciation-office buildings and equipment

Accumulated depreciation-store buildings and equipment

Allowance for doubtful accounts

Bonds payable, 5%, due in 10 years

Cash

Common stock, $20 par (400,000 shares authorized;

85,000 shares issued, 94,600 outstanding), January 1, 20Y8

Dividends:

Cash dividends for common stock

Cash dividends for preferred stock

Goodwill

Income tax payable

$150,000

3,700,000

30,000

30,000

100,000

140,500

21,000

30,000

7,500

14,000

50,000

170,000

10,000

5,313,000

185,000

385,000

21,000

$194,300

545,000

1,580,000

4,126,000

8,450

500,000

282,850

1,700,000

155,120

100,000

700,000

44,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare a

Solution

Follow-up Question

Prepare a

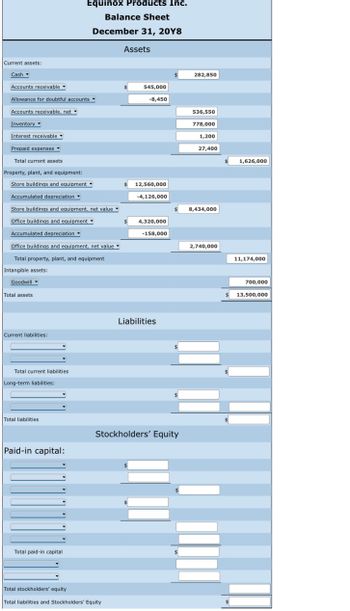

Transcribed Image Text:Current assets:

Cash

Accounts receivable

Allowance for doubtful accounts.

Accounts receivable, net

Inventory

Interest receivable

Prepaid expenses

Total current assets

Property, plant, and equipment:

Store buildings and equipment

Accumulated depreciation

Store buildings and equipment, net value

Office buildings and equipment

Accumulated depreciation

Office buildings and equipment, net value

Total property, plant, and equipment

Intangible assets:

Goodwill

Total assets

Current liabilities:

Total current liabilities

Long-term liabilities:

Equinox Products Inc.

Balance Sheet

December 31, 20Y8

Total liabilities

Paid-in capital:

Total paid-in capital

Assets

Total stockholders' equity

Total liabilities and Stockholders' Equity

$

545,000

-8,450

12,560,000

-4,126,000

4,320,000

-158,000

Liabilities

Stockholders' Equity

282,850

536,550

778,000

1,200

27,400

8,434,000

2,740,000

1,626,000

11,174,000

700,000

$ 13,500,000

Solution

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education