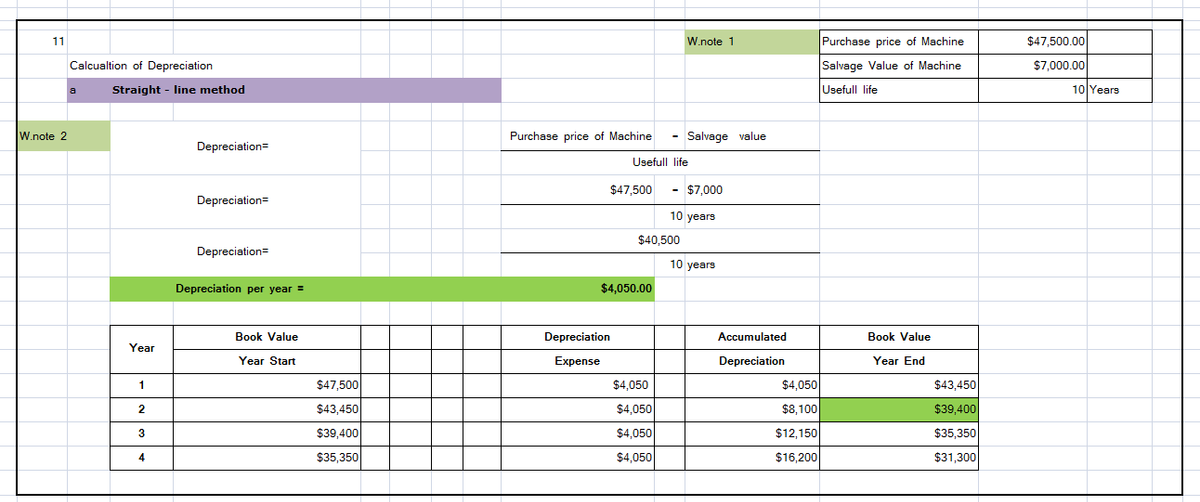

Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 34,500 units of product. Exercise 8-4 Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method.

Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 34,500 units of product. Exercise 8-4 Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

![mework Assignment i

es

C

CON

Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

Exercise 8-4 Straight-line depreciation LO P1

Esc

Straight-Line Depreciation

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of

$47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value.

During its second year, the machine produces 34,500 units of product.

Determine the machine's second-year depreciation and year end book value under the straight-line method.

Choose Numerator: /

Cost minus salvage

$

Year 2 Depreciation

Year end book value (Year 2)

F1

F2

40,500/

Estimated useful life (years)

$

✔

F3

Choose Denominator:

#

Dashboard

F4J

10

4,050

Prev.

F5

%

=

=

E

Paraphrasing Tool ....

Annual Depreciation

Expense

1

Depreciation expense

$

Saved

S

2 3

F6 G

A

C

logitech

4,050

of 9

F7

&

Excelsior Career De... Nationw

7

Score.answer >

F8

*

8

F9

(

9

F10

C](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F75b9eb0a-6c09-4640-9bd0-d00c787ecce6%2Fcc76ba80-a5dc-4c77-b1c4-41842ad55b8d%2Fu40lw5q_processed.jpeg&w=3840&q=75)

Transcribed Image Text:mework Assignment i

es

C

CON

Required information

Use the following information for the Exercises below.

[The following information applies to the questions displayed below.]

Exercise 8-4 Straight-line depreciation LO P1

Esc

Straight-Line Depreciation

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of

$47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value.

During its second year, the machine produces 34,500 units of product.

Determine the machine's second-year depreciation and year end book value under the straight-line method.

Choose Numerator: /

Cost minus salvage

$

Year 2 Depreciation

Year end book value (Year 2)

F1

F2

40,500/

Estimated useful life (years)

$

✔

F3

Choose Denominator:

#

Dashboard

F4J

10

4,050

Prev.

F5

%

=

=

E

Paraphrasing Tool ....

Annual Depreciation

Expense

1

Depreciation expense

$

Saved

S

2 3

F6 G

A

C

logitech

4,050

of 9

F7

&

Excelsior Career De... Nationw

7

Score.answer >

F8

*

8

F9

(

9

F10

C

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education