Peyton Smith enjoys listening to all types of music and owns countless CDs. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put together sets of recordings that appeal to all ages. During the last several months, Peyton served as a guest disc jockey on a local radio station. In addition, Peyton has entertained at several friends' parties as the host deejay. On June 1, 20YS, Peyton established a corporation known as PS Music. Using an extensive collection of music MP3 files, Peyton will serve as a disc jockey on a fee basis for weddings, college parties, and other events. During June, Peyton entered into the following transactions: June 1. Deposited $4,000 in a checking account in the name of PS Music in exchange for common stock. 2. Received $3,500 from a local radio station for serving as the guest disc jockey for June. 2. Agreed to share office space with a local real estate agency, Pinnacle Realty. PS Music will pay one-fourth of the rent. In addition, PS Music agreed to pay a portion of the wages of the receptionist and to pay one-fourth of the utilities. Paid $800 for the rent of the office. 4. Purchased supplies from City Office Supply Co. for $350. Agreed to pay $100 within 10 days and the remainder by July 5, 20Y5. 6. Paid $500 to a local radio station to advertise the services of PS Music twice daily for two weeks. 8. Paid $675 to a local electronics store for renting digital recording equipment. 12. Paid $350 (music expense) to Cool Music for the use of its current music demos to make various music sets. 13. Paid City Office Supply Co. $100 on account. 16. Received $300 from a dentist for providing two music sets for the dentist to play for her patients. 22. Served as disc jockey for a wedding party. The father of the bride agreed to pay $1,000 in July. 25. Received $500 for serving as the disc jockey for a cancer charity ball hosted by the local hospital. 29. Paid $240 (music expense) to Galaxy Music for the use of its library of music demos. 30. Received $900 for serving as PS disc jockey for a local club's monthly dance. 30. Paid Pinnacle Realty $400 for PS Music's share of the receptionist's wages for June. 30. Paid Pinnacle Realty $300 for PS Music's share of the utilities for June. 30. Determined that the cost of supplies on hand is $170. Therefore, the cost of supplies used during the month was $180. 30. Paid for miscellaneous expenses, $415. 30. Paid $1,000 royalties (music expense) to National Music Clearing for use of various artists' music during the month. 30. Paid dividends, $500. Required: Indicate the effect of each transaction and the balances after each transaction. Enter deductions and negative values (withdrawals and expenses) as negative numbers. For transactions occurring on the same date, enter in the order shown above.

Peyton Smith enjoys listening to all types of music and owns countless CDs. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put together sets of recordings that appeal to all ages. During the last several months, Peyton served as a guest disc jockey on a local radio station. In addition, Peyton has entertained at several friends' parties as the host deejay. On June 1, 20YS, Peyton established a corporation known as PS Music. Using an extensive collection of music MP3 files, Peyton will serve as a disc jockey on a fee basis for weddings, college parties, and other events. During June, Peyton entered into the following transactions: June 1. Deposited $4,000 in a checking account in the name of PS Music in exchange for common stock. 2. Received $3,500 from a local radio station for serving as the guest disc jockey for June. 2. Agreed to share office space with a local real estate agency, Pinnacle Realty. PS Music will pay one-fourth of the rent. In addition, PS Music agreed to pay a portion of the wages of the receptionist and to pay one-fourth of the utilities. Paid $800 for the rent of the office. 4. Purchased supplies from City Office Supply Co. for $350. Agreed to pay $100 within 10 days and the remainder by July 5, 20Y5. 6. Paid $500 to a local radio station to advertise the services of PS Music twice daily for two weeks. 8. Paid $675 to a local electronics store for renting digital recording equipment. 12. Paid $350 (music expense) to Cool Music for the use of its current music demos to make various music sets. 13. Paid City Office Supply Co. $100 on account. 16. Received $300 from a dentist for providing two music sets for the dentist to play for her patients. 22. Served as disc jockey for a wedding party. The father of the bride agreed to pay $1,000 in July. 25. Received $500 for serving as the disc jockey for a cancer charity ball hosted by the local hospital. 29. Paid $240 (music expense) to Galaxy Music for the use of its library of music demos. 30. Received $900 for serving as PS disc jockey for a local club's monthly dance. 30. Paid Pinnacle Realty $400 for PS Music's share of the receptionist's wages for June. 30. Paid Pinnacle Realty $300 for PS Music's share of the utilities for June. 30. Determined that the cost of supplies on hand is $170. Therefore, the cost of supplies used during the month was $180. 30. Paid for miscellaneous expenses, $415. 30. Paid $1,000 royalties (music expense) to National Music Clearing for use of various artists' music during the month. 30. Paid dividends, $500. Required: Indicate the effect of each transaction and the balances after each transaction. Enter deductions and negative values (withdrawals and expenses) as negative numbers. For transactions occurring on the same date, enter in the order shown above.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Topic Video

Question

100%

Chapter 1 - Instruction #1

Indicate the effect of each transaction and the balances after each transaction. Enter deductions and negative values (withdrawals and expenses) as negative numbers. For transactions occurring on the same date, enter in the order shown above.

Transcribed Image Text:Required:

Indicate the effect of each transaction and the balances after each transaction. Enter deductions and negative values (withdrawals and expenses) as negative numbers. For transactions occurring on the same date, enter in the order shown above.

Assets

Liabilities

Stockholders' Equity

Common

Office

Equip.

Accounts

Accounts

Smith,

Fees

Music

Rent

Rent

Advertising

Wages

Utilities

Supplies

Misc.

Cash

+

Receivable

Supplies

Payable

Stock

Dividends

Earned

Exp.

Exp.

Exp.

Exp.

Exp.

Exp.

Exp.

Exp.

June 1

June 2

Bal.

June 2

Bal.

June 4

Bal.

June 6

Bal.

June 8

Bal.

June 12

Bal.

June 13

Bal.

June 16

Bal.

June 22

Bal.

June 25

Bal.

June 29

Bal.

June 30

Bal.

June 30

Bal.

June 30

Bal.

June 30

Bal.

June 30

Bal.

June 30

Bal.

June 30

Bal.

Check My Work

Transcribed Image Text:Continuing Problem

Chapter 1 - Instruction #1

Peyton Smith enjoys listening to all types of music and owns countless CDs. Over the years, Peyton has gained a local reputation for knowledge of music from classical to rap and the ability to put together sets of recordings that appeal to all ages.

During the last several months, Peyton served as a guest disc jockey on a local radio station. In addition, Peyton has entertained at several friends' parties as the host deejay.

On June 1, 20Y5, Peyton established a corporation known as PS Music. Using an extensive collection of music MP3 files, Peyton will serve as a disc jockey on a fee basis for weddings, college parties, and other events. During June, Peyton entered into the following transactions:

June 1. Deposited $4,000 in a checking account in the name of PS Music in exchange for common stock.

2. Received $3,500 from a local radio station for serving as the guest disc jockey for June.

2. Agreed to share office space with a local real estate agency, Pinnacle Realty. PS Music will pay one-fourth of the rent. In addition, PS Music agreed to pay a portion of the wages of the receptionist and to pay one-fourth of the utilities. Paid $800 for the rent of the office.

4. Purchased supplies from City Office Supply Co. for $350. Agreed to pay $100 within 10 days and the remainder by July 5, 20Y5.

6. Paid $500 to a local radio station to advertise the services of PS Music twice daily for two weeks.

8. Paid $675 to a local electronics store for renting digital recording equipment.

12. Paid $350 (music expense) to Cool Music for the use of its current music demos to make various music sets.

13. Paid City Office Supply Co. $100 on account.

16. Received $300 from a dentist for providing two music sets for the dentist to play for her patients.

22. Served as disc jockey for a wedding party. The father of the bride agreed to pay $1,000 in July.

25. Received $500 for serving as the disc jockey for a cancer charity ball hosted by the local hospital.

29. Paid $240 (music expense) to Galaxy Music for the use of its library of music demos.

30. Received $900 for serving as PS disc jockey for a local club's monthly dance.

30. Paid Pinnacle Realty $400 for PS Music's share of the receptionist's wages for June.

30. Paid Pinnacle Realty $300 for PS Music's share of the utilities for June.

30. Determined that the cost of supplies on hand is $170. Therefore, the cost of supplies used during the month was $180.

30. Paid for miscellaneous expenses, $415.

30. Paid $1,000 royalties (music expense) to National Music Clearing for use of various artists' music during the month.

30. Paid dividends, $500.

Required:

Indicate the effect of each transaction and the balances after each transaction. Enter deductions and negative values (withdrawals and expenses) as negative numbers. For transactions occurring on the same date, enter in the order shown above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

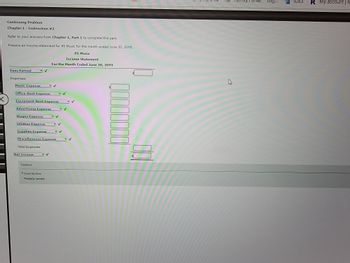

Transcribed Image Text:### Continuing Problem

**Chapter 1 - Instruction #2**

Refer to your answers from **Chapter 1, Part 1** to complete this part.

Prepare an income statement for PS Music for the month ended June 30, 20Y5.

---

**PS Music**

**Income Statement**

*For the Month Ended June 30, 20Y5*

- **Fees Earned:** $__________

**Expenses:**

- **Music Expense:** $__________

- **Office Rent Expense:** $__________

- **Equipment Rent Expense:** $__________

- **Advertising Expense:** $__________

- **Wages Expense:** $__________

- **Utilities Expense:** $__________

- **Supplies Expense:** $__________

- **Miscellaneous Expense:** $__________

- **Total Expenses:** $__________

- **Net Income:** $__________

---

**Feedback Section:**

- Check My Work

- Partially correct

**Note:** The template is structured to calculate the net income by subtracting total expenses from fees earned.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education