Record each Window World transaction with Nile Jenkins. In order to demonstrate the write-off and then subsequent collection of an account receivable, assume in this example that Window World rarely extends credit directly, so this transaction is permitted to use the direct write-off method. Remember, however, that in most cases the direct write-off method is not allowed. Record the event on April 2 to recognize the sale. If journal entry is required, please select at least one debit entry and one credit entry. If journal entry is not required, please select "no entry required".

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

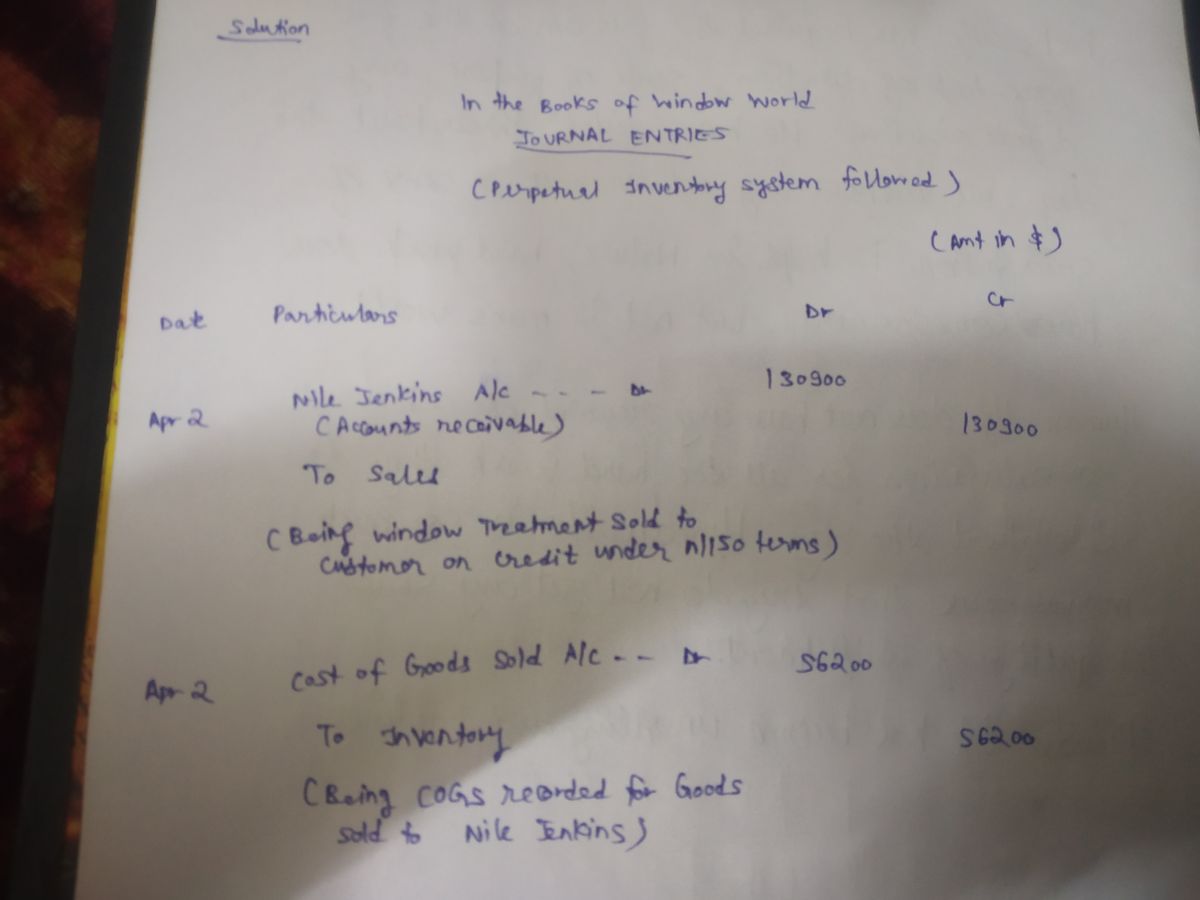

Window World extended credit to customer Nile Jenkins in the amount of $130,900 for his purchase of window treatments on April 2. Terms of the sale are n/150. The cost of the purchase to Window World is $56,200. (Perpetual inventory system is used)

On September 4, Window World determined that Nile Jenkins’s account was uncollectible and wrote off the debt. On December 3, Mr. Jenkins unexpectedly paid in full on his account. Record each Window World transaction with Nile Jenkins.

In order to demonstrate the write-off and then subsequent collection of an

- Record the event on April 2 to recognize the sale.

If

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images