Question 1 The management of Farzana Enterprise has asked you to prepare their financial statements for the year ended 30 June 2022. The company's trial balance as at that date is as follows: Trial Balance of Farzana Enterprise as at 30 June 2022 Debit (RM) 320,000 45,000 151,000 7,500 Purchases and sales Discount allowed Salaries expenses Bad debts Insurance Interest expenses Telephone and internet charges Rental and maintenance General expenses Capital Tools Carriage outwards Carriage inwards Return inwards Investments Land Building Furniture and Fixtures (RM) Accumulated depreciation - Building Accumulated depreciation - Furniture and Fixtures 6% Loan from Ambank, 15 years Bank overdraft Cash Account Receivables Inventories, 1 July Account Payables Drawings 27,000 7,875 3,750 30,000 41,850 82,500 30,000 8,500 1,500 175,000 400,000 180,000 45,000 27,000 92,100 87,900 45,000 Credit 896,625 1. Furniture and Fixtures 10% on cost, yearly basis 2. Building 15% on Net Book Value, yearly basis 5. Additional bad debt of RM800 was to be written off. 500,000 57,000 9,600 262,500 34,000 48,750 1,808,475 1,808,475 Additional Information: 1. Inventory as at 30 June 2022 was RM55,000 2. Included in the carriage outward is carriage inwards amounting to RM500. 3. The owner had taken RM800 of goods for her personal use 4. Depreciation is to be provided as follows: 6. Allowance for doubtful debt is to be adjusted to 2% on the outstanding account receivables 7. The company has not yet paid half of the interest on loan for the year end 2022. 8. The expenses below were still unpaid on 30 June 2022: 1. Telephone and internet RM400 2. General expenses RM500 9. The Insurance expense was paid for the period from 1 December 2021 to 30 November 2022 Note: Show all relevant workings and journal entries for adjustments. Required: A. Statement of Profit or Loss and other Comprehensive Income for the year ended 30 June 2022 B. Statement of Financial Position as at 30 June 2022

Question 1 The management of Farzana Enterprise has asked you to prepare their financial statements for the year ended 30 June 2022. The company's trial balance as at that date is as follows: Trial Balance of Farzana Enterprise as at 30 June 2022 Debit (RM) 320,000 45,000 151,000 7,500 Purchases and sales Discount allowed Salaries expenses Bad debts Insurance Interest expenses Telephone and internet charges Rental and maintenance General expenses Capital Tools Carriage outwards Carriage inwards Return inwards Investments Land Building Furniture and Fixtures (RM) Accumulated depreciation - Building Accumulated depreciation - Furniture and Fixtures 6% Loan from Ambank, 15 years Bank overdraft Cash Account Receivables Inventories, 1 July Account Payables Drawings 27,000 7,875 3,750 30,000 41,850 82,500 30,000 8,500 1,500 175,000 400,000 180,000 45,000 27,000 92,100 87,900 45,000 Credit 896,625 1. Furniture and Fixtures 10% on cost, yearly basis 2. Building 15% on Net Book Value, yearly basis 5. Additional bad debt of RM800 was to be written off. 500,000 57,000 9,600 262,500 34,000 48,750 1,808,475 1,808,475 Additional Information: 1. Inventory as at 30 June 2022 was RM55,000 2. Included in the carriage outward is carriage inwards amounting to RM500. 3. The owner had taken RM800 of goods for her personal use 4. Depreciation is to be provided as follows: 6. Allowance for doubtful debt is to be adjusted to 2% on the outstanding account receivables 7. The company has not yet paid half of the interest on loan for the year end 2022. 8. The expenses below were still unpaid on 30 June 2022: 1. Telephone and internet RM400 2. General expenses RM500 9. The Insurance expense was paid for the period from 1 December 2021 to 30 November 2022 Note: Show all relevant workings and journal entries for adjustments. Required: A. Statement of Profit or Loss and other Comprehensive Income for the year ended 30 June 2022 B. Statement of Financial Position as at 30 June 2022

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.

Transcribed Image Text:Question 1

The management of Farzana Enterprise has asked you to prepare their financial statements for the year ended 30 June

2022. The company's trial balance as at that date is as follows:

Trial Balance of Farzana Enterprise as at 30 June 2022

Purchases and sales

Discount allowed

Salaries expenses

Bad debts

Insurance

Interest expenses

Telephone and internet charges

Rental and maintenance

General expenses

Capital

Tools

Carriage outwards

Carriage inwards

Return inwards

Investments

Land

Building

Furniture and Fixtures

Accumulated depreciation - Building

Accumulated depreciation - Furniture and Fixtures

6% Loan from Ambank, 15 years

Bank overdraft

Cash

(RM)

Account Receivables

Inventories, 1 July

Account Payables

Drawings

Debit

(RM)

320,000

45,000

151,000

7,500

27,000

7,875

3,750

30,000

41,850

82,500

30,000

8,500

1,500

175,000

400,000

180,000

45,000

27,000

92,100

87,900

45,000

Credit

896,625

1. Furniture and Fixtures 10% on cost, yearly basis

2. Building 15% on Net Book Value, yearly basis

5. Additional bad debt of RM800 was to be written off.

500,000

57,000

9,600

262,500

34,000

48,750

1,808,475 1,808,475

Additional Information:

1. Inventory as at 30 June 2022 was RM55,000

2. Included in the carriage outward is carriage inwards amounting to RM500.

3. The owner had taken RM800 of goods for her personal use

4. Depreciation is to be provided as follows:

6. Allowance for doubtful debt is to be adjusted to 2% on the outstanding account receivables

7. The company has not yet paid half of the interest on loan for the year end 2022.

8. The expenses below were still unpaid on 30 June 2022:

1. Telephone and internet RM400

2. General expenses RM500

9. The Insurance expense was paid for the period from 1 December 2021 to 30 November 2022

Note: Show all relevant workings and journal entries for adjustments.

Required:

A. Statement of Profit or Loss and other Comprehensive Income for the year ended 30 June 2022

B. Statement of Financial Position as at 30 June 2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:1:51

Back FA - INDIVIDUAL ASSIG...

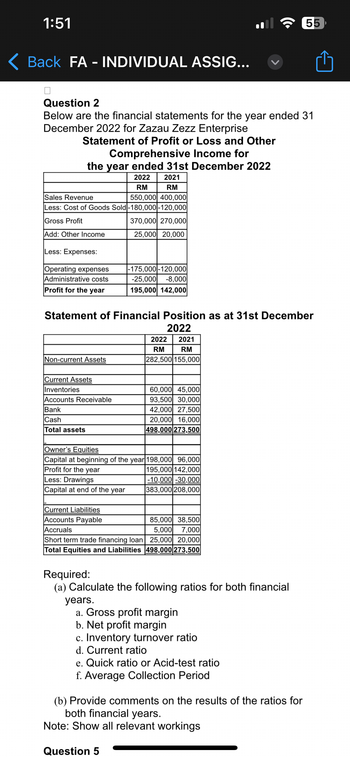

Question 2

Below are the financial statements for the year ended 31

December 2022 for Zazau Zezz Enterprise

Statement of Profit or Loss and Other

Comprehensive Income for

the year ended 31st December 2022

2022

2021

RM

RM

550,000 400,000

Sales Revenue

Less: Cost of Goods Sold-180,000-120,000

Gross Profit

Add: Other Income

Less: Expenses:

Operating expenses

Administrative costs

Profit for the year

Non-current Assets

Current Assets

Inventories

Accounts Receivable

Bank

Cash

Total assets

Statement of Financial Position as at 31st December

2022

Current Liabilities

Accounts Payable

Accruals

370,000 270,000

25,000 20,000

-175,000-120,000

years.

-25,000 -8,000

195,000 142,000

2022

2021

RM

RM

282,500 155,000

60,000 45,000

93,500 30,000

Owner's Equities

Capital at beginning of the year 198,000 96,000

Profit for the year

195,000 142,000

Less: Drawings

-10,000-30,000

Capital at end of the year

383,000 208,000

Question 5

42,000 27,500

20,000 16,000

498,000 273,500

85,000 38,500

Short term trade financing loan 25,000 20,000

Total Equities and Liabilities 498,000 273,500

5,000 7,000

Required:

(a) Calculate the following ratios for both financial

a. Gross profit margin

b. Net profit margin

c. Inventory turnover ratio

d. Current ratio

e. Quick ratio or Acid-test ratio

f. Average Collection Period

55

(b) Provide comments on the results of the ratios for

both financial years.

Note: Show all relevant workings

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education