Consider the following short descriptions. Indicate whether each description more closely relates to a major feature of financial accounting (use FA) or management accounting (use MA) a. Behavioral impact is secondary b. Is constrained by generally accepted accounting principles C. Has a future orientation d. Is characterized by detailed reports e. Field is more sharply defined f. Has less flexibility on

Consider the following short descriptions. Indicate whether each description more closely relates to a major feature of financial accounting (use FA) or management accounting (use MA) a. Behavioral impact is secondary b. Is constrained by generally accepted accounting principles C. Has a future orientation d. Is characterized by detailed reports e. Field is more sharply defined f. Has less flexibility on

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:1.2

Consider the following short descriptions. Indicate whether each description more

closely relates to a major feature of financial accounting (use FA) or management accounting

(use MA)

a. Behavioral impact is secondary

b. Is constrained by generally accepted accounting principles

C. Has a future orientation

d. Is characterized by detailed reports

e. Field is more sharply defined

f. Has less flexibility

On

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:3.8

Cookie Light, Inc. normally produces 12,000 bottles of its product soda light. The

following data were provided to determine the following:

Material costs

Direct labor costs

P 80,000

Factory overhead, variable

Factory overhead, fixed

Beginning inventory in units

Units sold for the period

100,000

72,000

60,000

2,000

10,000

Net income for the year under the variable costing method is P40,000.

Instructions:

1. Determine the cost per unit of production under the two methods.

2. Determine the cost of goods sold under the two methods.

3. Determine the net income under absorption costing.

3.9

The following data were taken from the records of C5 Drinks Company for the years

ending Year I and Year 2

Year 1

Year 2

In units

Inventory, beginning

Production

Available for sale

Units sold

20,000

20,000

13,000

7,000

P260,000

7,000

18,000

25,000

23,000

2,000

P460,000

Inventory ending

Sales (P20 per unit )

Variable Manufacturing cost (P7.50 per unit)

Fixed Manufacturing costs

Selling and administrative (60% fixed, 40% variable) 45,000

150,000

50,000

135,000

54,000

75,000

Instructions:

1. Determine the net income under absorption costing for Year I and Year 2.

2. Determine the net income under variable costing for Year 1 and Year 2.

3. Determine the cause of the difference in the two net incomes in Year 1 and Year 2.

Solution

Follow-up Question

Transcribed Image Text:22

An organization has the following total costs at two activity levels

P150,000 @ 16,000 units;

P200,000 @ 24,000 units

Variable costs per unit is constant in this range of activity and there is a step down of

P20,000 in the total fixed costs when activity is below 18,000 units.

1. What is the total cost at an activity level of 17,000 units?

2 What is the total cost at an activity level of 25,000 units?

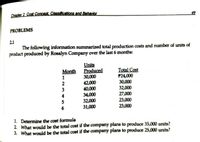

Transcribed Image Text:Chepter 2 Cost Concent. Classifications and Behavior

49

PROBLEMS

21

The following information summarized total production costs and number of units of

product produced by Rosalyn Company over the last 6 months:

Units

Produced

30,000

42,000

40,000

34,000

32,000

31,000

Total Cost

P24,000

30,000

32,000

27,000

23,000

23,000

Month

4

1. Determine the cost formula

2. What would be the total cost if the company plans to produce 35,000 units?

3. What would be the total cost if the company plans to produce 25,000 units?

123 56

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education