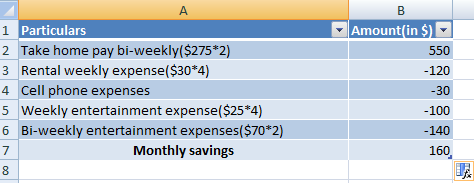

Problem 8: Oliver is just starting his last year of high school. He has take-home pay of $275 bi-weekly from a part-time job. He lives at home and pays $30 per week for room and board. His other expenses are: • $30 per month for a cell phone • $25 per week for entertainment • $70 bi-weekly for miscellaneous items Create a monthly budget for Oliver using the spreadsheet template. How much money can he save each month?

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Budgeting- It is the process of creating a spending plan to spend one's money in order to determine in advance whether there will be sufficient funds to meet expenses for the period for which the budget is being prepared.

Monthly budget for Oliver(assuming 4 weeks in a month)-

Step by step

Solved in 3 steps with 1 images