Please see images

Please see images

Inventory is the goods and material a business holds for resale.

LIFO:- As the name suggests Last in First out, this method assumes that the inventory purchased first are sold last and inventory purchased last is sold first. It is exact opposite than the FIFO assumption.

Weighted Average Cost:- The third method is weighted average cost method. The weighted average cost method is used to assign the average cost of production to a product.

Under weighted average cost method, cost of all available units are added up and then this total cost is divided by total number of available units, thus per unit cost is calculated and this per unit cost is assigned to units sold to calculate cost of goods sold and it is also assigned to ending unit to calculate value of ending units.

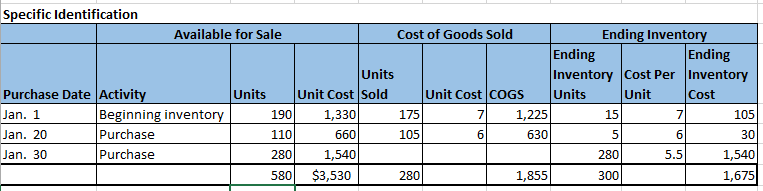

Specific Identification,

For units sold we will get the remaining units from the ending inventory as given in the question.

We will get 175 units from Jan 1 beginning inventory and 105 units from the Jan 20 purchase.

Therefore, cost of goods sold is $1,855.

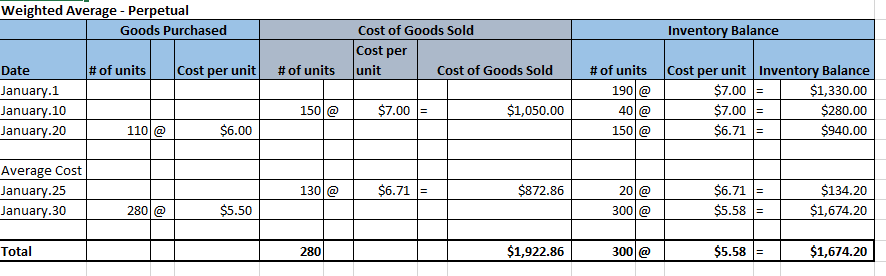

Weighted average - Perpetual

First we have the beginning inventory on Jan 1 then we will sale the 150 units on Jan 10 from given beginning lot.

When we have the purchase on Jan 20 our inventory balance will be last balance plus new purchase and value is also the same for that purchase but for the cost per unit we have to divide the Inventory balance with # of units. therefore we will get the $6.71 ($940/150 units). This process is called as average cost.

For Jan 25 we will sale the 130 units for $6.71 as we have balance in the inventory for that unit rate.

and last we have the Jan 30 purchase for that we will add 280 units to 20 units remained in the balance inventory and average cost is also calculated on the 300 units and $1,674.20 inventory balance. Therefore, cost per unit is $5.58 ($1,674.20/300 units).

Step by step

Solved in 3 steps with 2 images