please help

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Can you please help with this problem. thanks

Transcribed Image Text:P4-5

Workpapers in year of acquisition (excess recorded for inventory, building, equipment,

trademarks, and goodwill)

Pam Corporation acquired a 70 percent interest in Sun Corporation's outstanding voting common stock

on January 1, 2016, for $980,000 cash. The stockholders' equity (book value) of Sun on this date consisted

of $1,000,000 capital stock and $200,000 retained earnings. The differences between the fair value of

Sun and the book value of Sun were assigned $10,000 to Sun's undervalued inventory, $28,000 to under-

valued buildings, $42,000 to undervalued equipment, and $80,000 to previously unrecorded trademarks.

Any remaining excess is goodwill.

The undervalued inventory items were sold during 2016, and the undervalued buildings and

equipment had remaining useful lives of seven years and three years, respectively. The trademarks

have a 40-year life. Depreciation is straight line.

At December 31, 2016, Sun's accounts payable include $20,000 owed to Pam. This $20,000

account payable is due on January 15, 2017. Separate financial statements for Pam and Sun for 2016

are summarized as follows (in thousands):

Pam

Sun

Combined Income and Retained Earnings

Statements for the Year Ended December 31

Sales

$ 1,600

$1,400

119

Income from Sun

(600)

(308)

(320)

491

(800)

(120)

(280)

200

Cost of sales

Depreciation expense

Other expenses

Net income

600

200

Add: Retained earnings January 1

Deduct: Dividends 05

Retained earnings December 31

(400)

2 691

(100)

$4300

Transcribed Image Text:Pam

Sun

016 $ 120

00 140 A

Balance Sheet at December 31

2$

$172

Cash

Accounts receivable-net

Dividends receivable

200

28

nou

300

200

Inventories

60

140

ot sidavi

100

Other current assets

Land

200

280

320

Buildings-net

Equipment-net

Investment in Sun

1,140

1,029

$ 3,389 $1,700

660

Total assets

Accounts payable

Dividends payable

Other liabilities

$ 400

200ldevo

98 02

2,000ld 1,000

691 012

$3,389

$ 170

40

oi olde 190

Capital stock, $20 par

Retained earnings

Total equities

300

m $1,700

REQUIRED:Prepare consolidation workpapers for Pam Corporation and Subsidiary for the year ended

December 31, 2016. Use an unamortized excess account.

BAcbere co

Expert Solution

Step 1

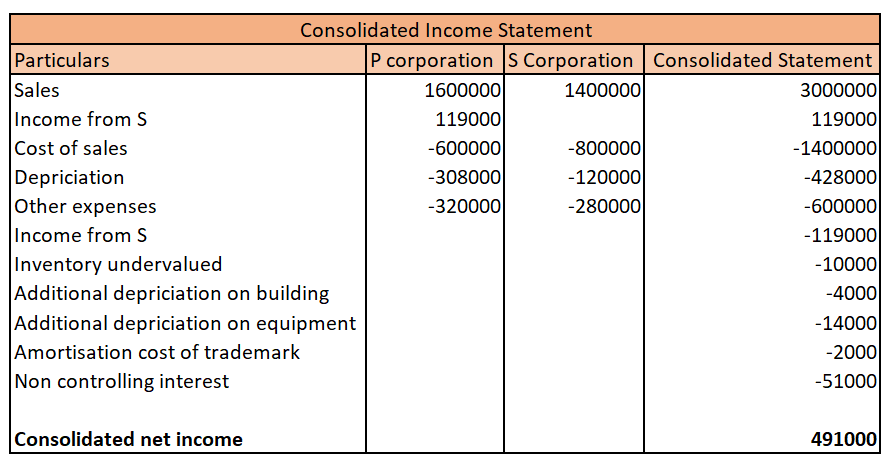

Consolidated statements:

Consolidated financial statements consist of Balance sheet, Income statement, Cost sheet, etc. Consolidated financial statements are those statements that are strictly have collective information of a parent company and its subsidiaries. GAAP and IFRS include various provisions that help to create the framework for consolidated subsidiary financial statement reporting

Step 2

a.

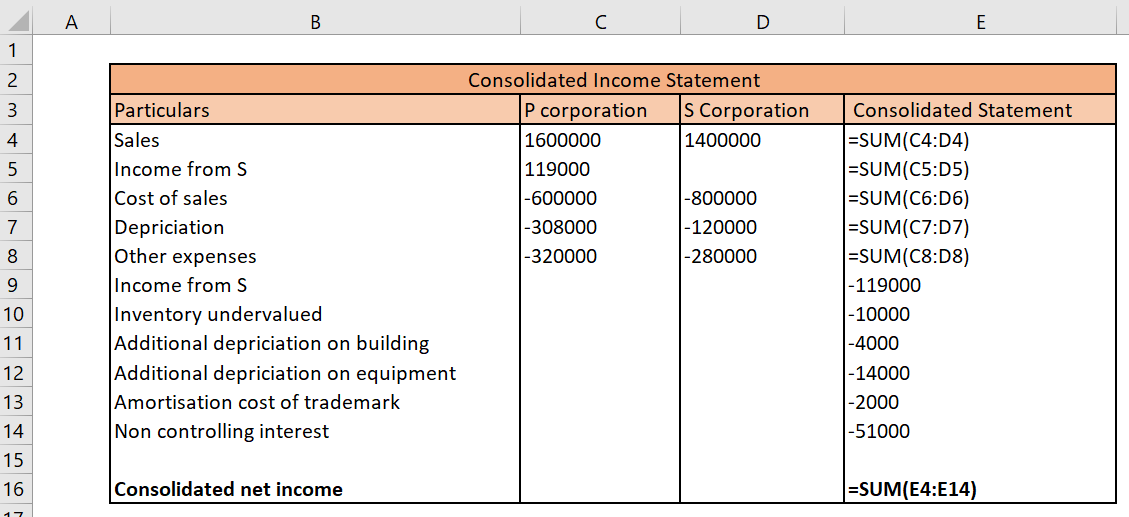

Consolidate income statement is as follows:

Step 3

Calculation:

Step 4

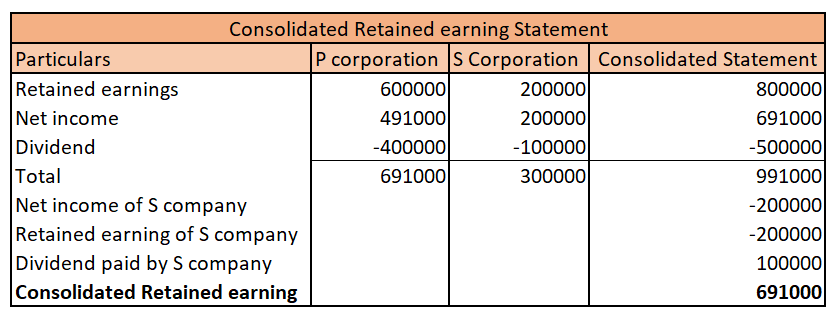

b.

Consolidated retained earning statement is as follows:

Step by step

Solved in 7 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education