PharmPic is considering the following project with the following cash flows: PharmPic Project Period Cash Flow 0 -$50,000 1 -$7,000 2 -$40,000 3 $10,000 4 $5,000 5 $20,000 6 $25,000 7 $32,000 8 $37,000 DosageDoc is considering the following project with the following cash flows: DosageDoc Project Period Cash Flow 0 -$50,000 1 70,000 2 -40,000 3 30,000 4 -7,000 PharmPic Project’s cash flows are semi-annually. PharmPic has the following two financing choices; loan with an APR of 6.5% compounding semi-annually or a loan with an APR of 6.35% compounding quarterly. DosageDoc Project’s cash flows are annually. DosageDoc has the following two financing choices; loan with an 8.45% rate over four years or a loan based with an APR of 2.5% compounding daily. Which firm’s project satisfies the most decision rules when the current payback period requirement is a half a year and the discounted payback period requirement is 1 years. Do a complete analysis of these projects. Include all the decision rules and considerations

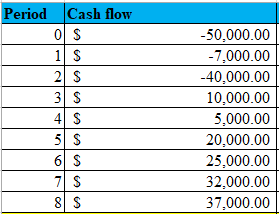

PharmPic is considering the following project with the following cash flows:

PharmPic Project

Period Cash Flow

0 -$50,000

1 -$7,000

2 -$40,000

3 $10,000

4 $5,000

5 $20,000

6 $25,000

7 $32,000

8 $37,000

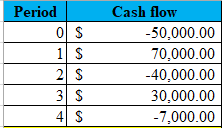

DosageDoc is considering the following project with the following cash flows:

DosageDoc Project

Period Cash Flow

0 -$50,000

1 70,000

2 -40,000

3 30,000

4 -7,000

PharmPic Project’s cash flows are semi-annually. PharmPic has the following two financing choices; loan with an APR of 6.5% compounding semi-annually or a loan with an APR of 6.35% compounding quarterly.

DosageDoc Project’s cash flows are annually. DosageDoc has the following two financing choices; loan with an 8.45% rate over four years or a loan based with an APR of 2.5% compounding daily.

Which firm’s project satisfies the most decision rules when the current payback period requirement is a half a year and the discounted payback period requirement is 1 years. Do a complete analysis of these projects. Include all the decision rules and considerations.

Cash flows for Pharmpic project:

Cash flows for DosageDoc project

To Find:

- Payback period

- Discounted payback period

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images