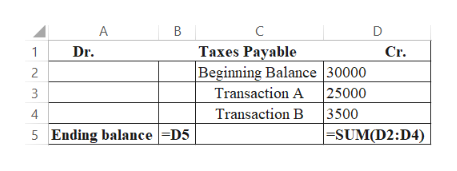

Parrish 2-8 #2 Pg 32Complete this as a T-Account. Calculate the missing amount and write it in the space in the T-Account. Assume that the beginning and ending balances are on the normal side of the account, that, the side on which the balance increaes Taxes Payable On the left side of the T-Account1) 2/28 $ Unknown -Debit On right side of T-Account2) 2/1 Beginning balance $300003) 2/6 Transaction A $250004) Transaction B $3500

Parrish 2-8 #2 Pg 32Complete this as a T-Account. Calculate the missing amount and write it in the space in the T-Account. Assume that the beginning and ending balances are on the normal side of the account, that, the side on which the balance increaes Taxes Payable On the left side of the T-Account1) 2/28 $ Unknown -Debit On right side of T-Account2) 2/1 Beginning balance $300003) 2/6 Transaction A $250004) Transaction B $3500

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter5: Accounting Systems

Section: Chapter Questions

Problem 5.21EX: Cash receipts journal The following cash receipts journal headings have been suggested for a small...

Related questions

Question

Parrish 2-8 #2 Pg 32

Complete this as a T-Account. Calculate the missing amount and write it in the space in the T-Account. Assume that the beginning and ending balances are on the normal side of the account, that, the side on which the balance increaes

Taxes Payable

On the left side of the T-Account

1) 2/28 $ Unknown -Debit

On right side of T-Account

2) 2/1 Beginning balance $30000

3) 2/6 Transaction A $25000

4) Transaction B $3500

Expert Solution

Step 1

Required T-account:

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning