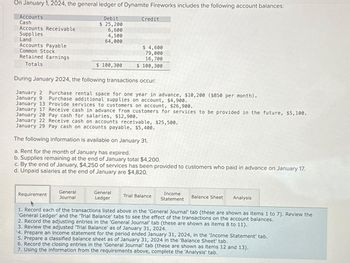

On January 1, 2024, the general ledger of Dynamite Fireworks includes the following account balances: Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 25,200 6,600 4,500 64,000 Requirement $ 100,300 General Journal During January 2024, the following transactions occur: January 2 Purchase rental space for one year in advance, $10,200 ($850 per month). January 9 Purchase additional supplies on account, $4,900. January 13 Provide services to customers on account, $26,900. Credit January 17 Receive cash in advance from customers for services to be provided in the future, $5,100. January 20 Pay cash for salaries, $12,900. January 22 Receive cash on accounts receivable, $25,500. January 29 Pay cash on accounts payable, $5,400. The following information is available on January 31. a. Rent for the month of January has expired. b. Supplies remaining at the end of January total $4,200. c. By the end of January, $4,250 of services has been provided to customers who paid in advance on January 17. d. Unpaid salaries at the end of January are $4,820. $ 4,600 79,000 16,700 $ 100,300 General Ledger Trial Balance Income Statement Balance Sheet Analysis 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 7). Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8 to 11). 3. Review the adjusted 'Trial Balance' as of January 31, 2024. 4. Prepare an income statement for the period ended January 31, 2024, in the 'Income Statement' tab. 5. Prepare a classified balance sheet as of January 31, 2024 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 12 and 13). 7. Using the information from the requirements above, complete the 'Analysis' tab.

On January 1, 2024, the general ledger of Dynamite Fireworks includes the following account balances: Accounts Cash Accounts Receivable Supplies Land Accounts Payable Common Stock Retained Earnings Totals Debit $ 25,200 6,600 4,500 64,000 Requirement $ 100,300 General Journal During January 2024, the following transactions occur: January 2 Purchase rental space for one year in advance, $10,200 ($850 per month). January 9 Purchase additional supplies on account, $4,900. January 13 Provide services to customers on account, $26,900. Credit January 17 Receive cash in advance from customers for services to be provided in the future, $5,100. January 20 Pay cash for salaries, $12,900. January 22 Receive cash on accounts receivable, $25,500. January 29 Pay cash on accounts payable, $5,400. The following information is available on January 31. a. Rent for the month of January has expired. b. Supplies remaining at the end of January total $4,200. c. By the end of January, $4,250 of services has been provided to customers who paid in advance on January 17. d. Unpaid salaries at the end of January are $4,820. $ 4,600 79,000 16,700 $ 100,300 General Ledger Trial Balance Income Statement Balance Sheet Analysis 1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 7). Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8 to 11). 3. Review the adjusted 'Trial Balance' as of January 31, 2024. 4. Prepare an income statement for the period ended January 31, 2024, in the 'Income Statement' tab. 5. Prepare a classified balance sheet as of January 31, 2024 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 12 and 13). 7. Using the information from the requirements above, complete the 'Analysis' tab.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. A question credit has been added to your account for future use.

Your Question:

Transcribed Image Text:On January 1, 2024, the general ledger of Dynamite Fireworks includes the following account balances:

Accounts

Cash

Accounts Receivable

Supplies

Land

Accounts Payable

Common Stock

Retained Earnings

Totals

Debit

$ 25,200

6,600

4,500

64,000

Requirement

$ 100,300

General

Journal

During January 2024, the following transactions occur:

January 2 Purchase rental space for one year in advance, $10,200 ($850 per month).

January 9 Purchase additional supplies on account, $4,900.

January 13 Provide services to customers on account, $26,900.

Credit

January 17 Receive cash in advance from customers for services to be provided in the future, $5,100.

January 20 Pay cash for salaries, $12,900.

January 22 Receive cash on accounts receivable, $25,500.

January 29 Pay cash on accounts payable, $5,400.

The following information is available on January 31.

a. Rent for the month of January has expired.

b. Supplies remaining at the end of January total $4,200.

c. By the end of January, $4,250 of services has been provided to customers who paid in advance on January 17.

d. Unpaid salaries at the end of January are $4,820.

$ 4,600

79,000

16,700

$ 100,300

General

Ledger

Trial Balance

Income

Statement

Balance Sheet

Analysis

1. Record each of the transactions listed above in the 'General Journal' tab (these are shown as items 1 to 7). Review the

'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances.

2. Record the adjusting entries in the 'General Journal' tab (these are shown as items 8 to 11).

3. Review the adjusted 'Trial Balance' as of January 31, 2024.

4. Prepare an income statement for the period ended January 31, 2024, in the 'Income Statement' tab.

5. Prepare a classified balance sheet as of January 31, 2024 in the 'Balance Sheet' tab.

6. Record the closing entries in the 'General Journal' tab (these are shown as items 12 and 13).

7. Using the information from the requirements above, complete the 'Analysis' tab.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT