On January 1, 2021, CAE Company acquires an asset for $450,000,000. It had to spend an additional $24,000,000 to prepare the asset for the management’s intended use. The asset’s retirement costs at the end of its useful life of 30 years are estimated to $130,000,000. The discount rate is 5%. The asset’s residual value is $80,000,000 and the straight-line method is used for depreciation. CAE Company applies IFRS. Ignore decimals in your calculations. Required- Prepare the journal entry to record the acquisition of the asset on January 1, 2021, assuming cash is used to pay for the asset’s related costs (other than the ARO). Prepare all required adjusting entries on December 31, 2021 and December 31, 2022. Assume that on January 1st, 2030, the asset’s retirement costs are re-estimated to $150,000,000, while the asset’s total useful life is shortened to 25 years. The discount rate to be used is 5.5%. Prepare the journal entry to record this change on January 1st, 2030 and the required adjusting entries on December 31, 2030.

On January 1, 2021, CAE Company acquires an asset for $450,000,000. It had to spend an additional $24,000,000 to prepare the asset for the management’s intended use. The asset’s retirement costs at the end of its useful life of 30 years are estimated to $130,000,000. The discount rate is 5%. The asset’s residual value is $80,000,000 and the straight-line method is used for

Ignore decimals in your calculations.

Required-

- Prepare the

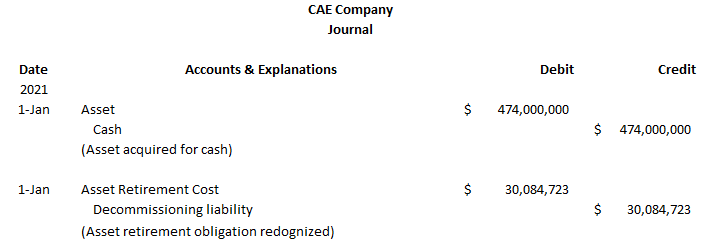

journal entry to record the acquisition of the asset on January 1, 2021, assuming cash is used to pay for the asset’s related costs (other than the ARO). - Prepare all required

adjusting entries on December 31, 2021 and December 31, 2022. - Assume that on January 1st, 2030, the asset’s retirement costs are re-estimated to $150,000,000, while the asset’s total useful life is shortened to 25 years. The discount rate to be used is 5.5%. Prepare the journal entry to record this change on January 1st, 2030 and the required adjusting entries on December 31, 2030.

Cost of original asset: Cost of Acquisition + Installation charges

= $450 MN + $24 MN

= $474 MN

Asset retirement cost and the related liability should be shown at present value. The discount factor is 5%.

Asset retirement cost after 30 years will be: $130 MN

PV factor for $1.00 after 30 years @5% rate will be: 0.231

Present value of retirement liability: $130,000,000 x 0.231 = $30,084,723

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images