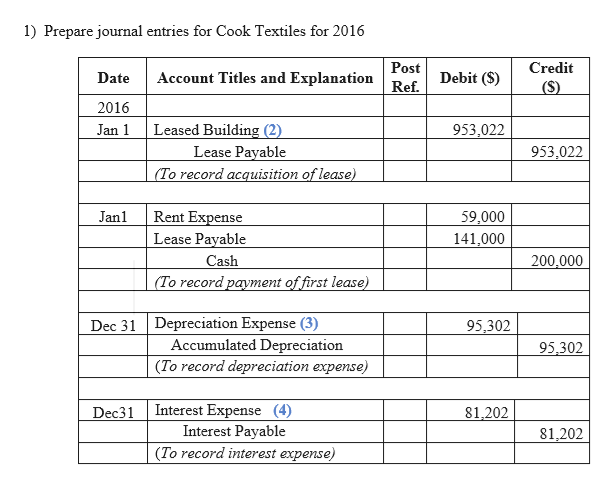

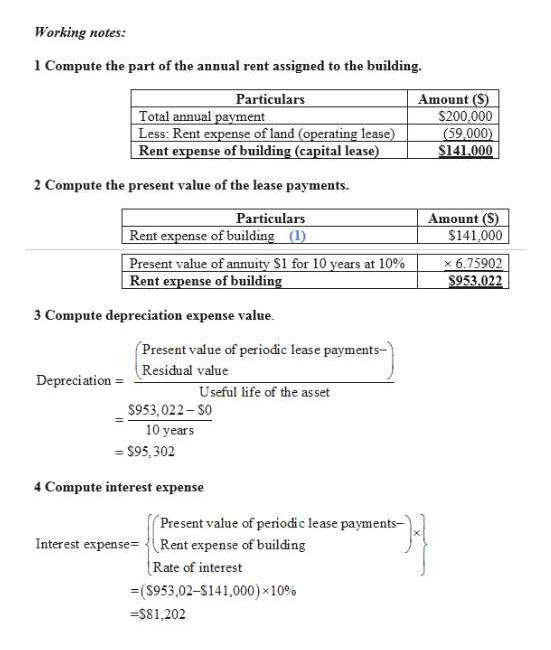

On January 1, 2016, Cook Textiles leased a building with two acres of land from Peck Development. The lease is for 10 years. No purchase option exists and the property will revert to Peck at the end of the lease. The building and land combined have a fair market value on January 1, 2016, of $1,450,000 and the building has an estimated life of 20 years with a residual value of $150,000. The lease calls for Cook to assume all costs of ownership and to make annual payments of $200,000 due at the beginning of each year. On January 1, 2016, the estimated value of the land was $400,000. Cook uses the straight-line method of depreciation and pays 10% interest on borrowed money. Peck’s implicit rate is unknown. Required: 1. Prepare journal entries for Cook Textiles for 2016. Assume the land could be leased without the building for $59,000 each year. 2. Assuming the land had a fair value on January 1, 2016, of $200,000 and could be leased alone for $30,000, prepare journal entries for Cook Textiles for 2016.

On January 1, 2016, Cook Textiles leased a building with two acres of land from Peck Development. The lease is

for 10 years. No purchase option exists and the property will revert to Peck at the end of the lease. The building

and land combined have a fair market value on January 1, 2016, of $1,450,000 and the building has an estimated

life of 20 years with a residual value of $150,000. The lease calls for Cook to assume all costs of ownership and

to make annual payments of $200,000 due at the beginning of each year. On January 1, 2016, the estimated value

of the land was $400,000. Cook uses the straight-line method of

money. Peck’s implicit rate is unknown.

Required:

1. Prepare

$59,000 each year.

2. Assuming the land had a fair value on January 1, 2016, of $200,000 and could be leased alone for $30,000,

prepare journal entries for Cook Textiles for 2016.

Step by step

Solved in 4 steps with 4 images