Oil prices have fallen quite substantially since 2008. Moreover, the deveopment of new sources of oil and natueral gas is taking place throughout the U.S. Use the AD-AS model (along with a labor market graph) to show and explain how this will affect Y, N, W/P, and P over time. Also, explain how the decrease in oil/energy prices makes the Fed’s job somewhat easier.

Oil

After the 2008 global economic crises, the United States landscape has shifted too dramatically driven new revolutionary technology that makes the oil extraction from shale rock formations. The regions that eased their oil production and surpassed Russia’s production which is world’s largest producer of oil and gas in 2014 include Texas, North Dakota, and Pennsylvania making the US the world’s leading producer of oil and gas. However, this development of new sources of oil and gas were not limited to only above three regions but it takes place in the whole parts of the US.

This major production of oil and gas by the US was able to reduce the oil and gas prices year by year making the US exporter of the oil and gas from being an importer. Thus, this reduction in oil price reduces the cost of production; thereby, shifts the aggregate supply curve rightwards. However, the reduction in production cost leaves consumers’ and investors with the higher levels of disposable income; thereby, boost-up the level of investment in the economy by shifting the AD (Aggregate Demand) curve rightwards. But, the overall impact of this shift in AS and AD has an uncertain impact over the economy’s price level i.e. the US economy’s price level might upsurge or decline depending upon the magnitude of an upsurge in AD and AS.

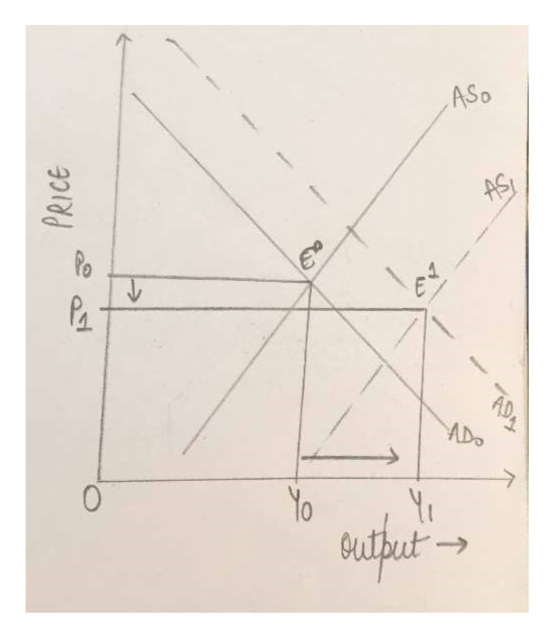

Case 1: when the AS shifts by a higher magnitude than the AD cause the aggregate price level to decline which can be seen from the below AD-AS diagram:

From this diagram, we can say the US economy was initially operating at point E0 where the aggregate price level in the economy was at P0 and the aggregate output was at Y0. However, with a rapid upsurge in the production, the price of oil in the US declines leading to an upsurge in the aggregate output production level along with a decline in the economy’s aggregate price level; thereby, the real GDP level also upsurges and the inflation rate declines over time in the US economy.

Step by step

Solved in 6 steps with 3 images