Оиestion two The cash book column of Wekesa showed a credit balance of Sh.1,040,350 while the bank statement balance showed an overdraft of Sh.1,398,000 on 31st July 2019. A detailed comparison of entries revealed the following; i) Cheques paid to the following creditors were not presented for payment at the bank, Mumbi Sh 195,400, Yash Sh 32,500, Sidhu Sh 164,300 On 31st July 2019, the sales made were Sh.1,053,700 and were deposited in the ii) evening. However, the sales were not recorded by the bank until the following day. i) The bank paid an insurance premium of Sh.75,300 because of a standing order arranged by Wekesa The bank deducted Sh.45,550 bank charges which were not yet recorded in the iv) cash book v) Interest received on a fixed deposit Sh.160,000 had not yet been recorded by the business. vi) The bank had received on behalf of Wekesa, a credit transfers of Sh.246,700 from Obiri vii) A cheque for Sh.135,500 which was paid by the bank was entered in the cash book as Sh.153,500 Required: a) Adjusted cash book b) Bank reconciliation statement as at 31 July 2019

Оиestion two The cash book column of Wekesa showed a credit balance of Sh.1,040,350 while the bank statement balance showed an overdraft of Sh.1,398,000 on 31st July 2019. A detailed comparison of entries revealed the following; i) Cheques paid to the following creditors were not presented for payment at the bank, Mumbi Sh 195,400, Yash Sh 32,500, Sidhu Sh 164,300 On 31st July 2019, the sales made were Sh.1,053,700 and were deposited in the ii) evening. However, the sales were not recorded by the bank until the following day. i) The bank paid an insurance premium of Sh.75,300 because of a standing order arranged by Wekesa The bank deducted Sh.45,550 bank charges which were not yet recorded in the iv) cash book v) Interest received on a fixed deposit Sh.160,000 had not yet been recorded by the business. vi) The bank had received on behalf of Wekesa, a credit transfers of Sh.246,700 from Obiri vii) A cheque for Sh.135,500 which was paid by the bank was entered in the cash book as Sh.153,500 Required: a) Adjusted cash book b) Bank reconciliation statement as at 31 July 2019

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Transcribed Image Text:b) The Balance Sheet as at 31" March 201

Оuestion two

The cash book column of Wekesa showed a credit balance of Sh.1,040,350 while the

bank statement balance showed an overdraft of Sh.1,398,000 on 31 July 2019. A

detailed comparison of entries revealed the following,

Cheques paid to the following creditors were not presented for payment at the

bank Mumbi Sh.195,400, Yash Sh.32,500, Sidhm Sh 164 300

On 31s July 2019, the sales made were Sh.1,053,700 and were deposited in the

i)

evening. However, the sales were not recorded by the bank until the following

day.

ii)

The bank paid an insurance premium of Sh.75,300 because of a standing order

arranged by Wekesa

The bank deducted Sh.45,550 bank charges which were not yet recorded in the

iv)

cash book

Interest received on a fixed deposit Sh.160,000 had not yet been recorded by

the business.

v)

vi)

The bank had received on behalf of Wekesa, a credit transfers of Sh.246,700

from Obiri

vii)

A cheque for Sh.135,500 which was paid by the bank was entered in the cash

book as Sh.153,500

Required:

a) Adjusted cash book

b) Bank reconciliation statement as at 31 July 2019

Expert Solution

Step 1

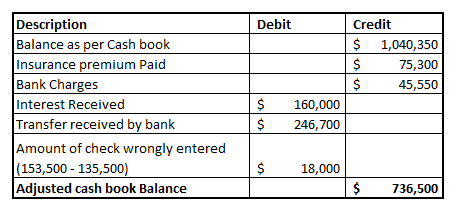

Following are the adjusted cash book and bank reconciliation

Step 2

Adjusted cash book

It recorded transactions which were not recorded in cash book or wrongly recorded in cash book

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education