Nougat Corporation wants to raise $4.9 million via a rights offering. The company currently has 550,000 shares of common stock outstanding that sell for $50 per share. Its underwriter has set a subscription price of $25 per share and will charge the company a spread of 5 percent. If you currently own 3,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) I keep getting the wrong answer, I get $2,430 and its not correct

Nougat Corporation wants to raise $4.9 million via a rights offering. The company currently has 550,000 shares of common stock outstanding that sell for $50 per share. Its underwriter has set a subscription price of $25 per share and will charge the company a spread of 5 percent. If you currently own 3,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

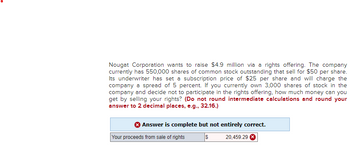

I keep getting the wrong answer, I get $2,430 and its not correct

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Hello, thank you for the help. The answer is coming back as incorrect.