Module 6 Question 3 Webb Solutions, Inc. has the following financial structure: Accounts payable $500,000 Short-term debt $250,000 Current liabilities $750,000 Long-term debt $750,000 Shareholders' equity $500,000 Total $2,000,000. a. Compute Webb's debt ratio and interest-bearing debt ratio. b. If the market value of Webb's equity is $2,000,000 and the value of the firm's debt is equal to its book value, assuming excess cash is zero, what is the debt-to-enterprise-value ratio for Webb? c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your analysis? a. What is Webb's debt ratio?

Module 6 Question 3 Webb Solutions, Inc. has the following financial structure: Accounts payable $500,000 Short-term debt $250,000 Current liabilities $750,000 Long-term debt $750,000 Shareholders' equity $500,000 Total $2,000,000. a. Compute Webb's debt ratio and interest-bearing debt ratio. b. If the market value of Webb's equity is $2,000,000 and the value of the firm's debt is equal to its book value, assuming excess cash is zero, what is the debt-to-enterprise-value ratio for Webb? c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your analysis? a. What is Webb's debt ratio?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Module 6 Question 3

Webb Solutions, Inc. has the following financial structure:

Accounts payable $500,000

Short-term debt $250,000

Current liabilities $750,000

Long-term debt $750,000

Shareholders' equity $500,000

Total $2,000,000.

Short-term debt $250,000

Current liabilities $750,000

Long-term debt $750,000

Shareholders' equity $500,000

Total $2,000,000.

a. Compute Webb's debt ratio and interest-bearing debt ratio.

b. If the market value of Webb's equity is $2,000,000 and the value of the firm's debt is equal to its book value, assuming excess cash is zero, what is the debt-to-enterprise-value ratio for Webb?

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your analysis?

a. What is Webb's debt ratio?

Expert Solution

Step 1

The mathematical relationship between two variables is called a ratio. Most often, investors employed ratio analysis to evaluate a company's financial performance before making an investment decision.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your analysis? (Select the best choice below.)

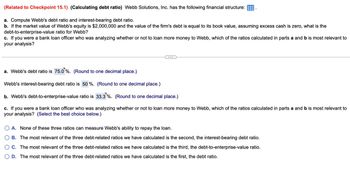

Transcribed Image Text:(Related to Checkpoint 15.1) (Calculating debt ratio) Webb Solutions, Inc. has the following financial structure:

a. Compute Webb's debt ratio and interest-bearing debt ratio.

b. If the market value of Webb's equity is $2,000,000 and the value of the firm's debt is equal to its book value, assuming excess cash is zero, what is the

debt-to-enterprise-value ratio for Webb?

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to

your analysis?

a. Webb's debt ratio is 75.0%. (Round to one decimal place.)

Webb's interest-bearing debt ratio is 50%. (Round to one decimal place.)

b. Webb's debt-to-enterprise-value ratio is 33.3%. (Round to one decimal place.)

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to

your analysis? (Select the best choice below.)

A. None of these three ratios can measure Webb's ability to repay the loan.

B. The most relevant of the three debt-related ratios we have calculated is the second, the interest-bearing debt ratio.

C. The most relevant of the three debt-related ratios we have calculated is the third, the debt-to-enterprise-value ratio.

D. The most relevant of the three debt-related ratios we have calculated is the first, the debt ratio.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education