McDonalds Annual Data | Millions of US $ except per share data 2016-12-31 2018-12-31 2017-12-31 2017-12-31 Annual Data 2018-12-31 Llal Net Income/Los $5,924.3 $5,192.3 $4,686.5 Llul Lll $1,482 $1,363.4 $1,516.5 1.3631 Total Depreciation And Amortization - Cash Flow 1.8429 Current Ratio Llul Lal $33.1 $-24 $-310.4 Long-term Debt / Capital Other Non-Cash Items 1.2522 1.1244 Llal Lll $1,515.1 $1,339.4 $1,206.1 Total Non-Cash Items Debt/Equity Ratio -4.9654 -9.0381 Change In Accounts Receivable Lll Lll $-479.4 $-340.7 $-159 Gross Margin 51.3003 46.5408 Llal $-1.9 $-37.3 Change In Inventories $28.1 Operating Margin 41.962 41.8604 Llil EBIT Margin $129.4 $-59.7 $89.8 Change In Accounts Payable 41.8604 41.962 Change In Assets/Liabilities Lll EBITDA Margin 49.0107 47.8348 $-980.5 Total Change In Assets/Liabilities $167 Pre-Tax Profit Margin 37.5695 $-472.7 37.1749 Llal $6,966.7 $5,551.2 $6,059.6 Net Profit Margin 22.7529 Cash Flow From Operating Activities 28.1771 Llul S-2,581.3 $-1,686.9 $-1,738.2 Net Change In Property, Plant, And Equipment 0.6408 Asset Turnover 0.6751 Net Change In Intangible Assets Inventory Turnover Ratio 200.3757 207.4762 $429.1 $2,494.8 $866.1 Net Acquisitions/Divestitures 11.5476 Receiveable Turnover 8.6116 Net Change In Short-term Investments Days Sales In Receivables 42.3847 31.6083 Llal Net Change In Long-Term Investments ROE - Return On Equity Lll -94.6616 -158.8832 Lll Return On Tangible Equity Net Change In Investments - Total -68.9682 -91.9365 Lll ROA - Return On Assets $-109.5 $-302.9 $-245.9 Investing Activities - Other 18.0557 15.3602 Llal ROI - Return On Investment Cash Flow From Investing Activities $-2,455.1 $562 $-981.6 23.872 19.7663 Net Long-Term Debt $2,034.9 $3,078.1 $2,956.6 Book Value Per Share -8.1585 -4.4517 Net Current Debt $95.9 $-1,050.3 $-286.2 Operating Cash Flow Per Share 8.868 6.8071 Debt Issuance/Retirement Net - Total Llul $2,130.8 Lll $2,027.8 $2,670.4 5.5822 4.7386 Free Cash Flow Per Share Llal $-4,804.5 $-4,228.9 $-10,871.6 Net Common Equity Issued/Repurchased Net Total Equity Issued/Repurchased S-4,804.5 $-4,228.9 $-10,871.6 Llal $-3,255.9 $-3,089.2 S-3,058.2 Total Common And Preferred Stock Dividends Paid Annual Data | Millions of US $ except per share data 2017-12-31 2018-12-31 2016-12-31 Lll $-20.5 $-20 $-3 Financial Activities - Other Cash On Hand $866 $2,463.8 $1,223.4 Llal $-5,949.6 $-5,310.8 $-11,262.4 Cash Flow From Financial Activities Notes And Loans Receivable Llal $-1,597.8 $1,240.4 $-6,462.1 Net Cash Flow $51.1 $58.8 $58.9 Inventory Lll $125.1 Stock-Based Compensation $117.5 $131.3 $1,527 Other Current Assets $-3,255.9 $-3,089.2 $-3,058.2 Common Stock Dividends Paid Llil $4,053.2 $5,327.2 $4,848.6 Total Current Assets Llal Property, Plant, And Equipment $22,842.7 $22,448.3 $21,257.6 Annual Data | Millions of US $ except per share data 2018-12-31 2016-12-31 Lll 2017-12-31 $725.9 Long-Term Investments $1,202.8 $1,085.7 Lll Goodwill And Intangible Assets $2,331.5 $2,379.7 $2,336.5 Llul $22,820.4 $21,025.2 $24,621.9 Revenue Llul Other Long-Term Assets $2,381 $2,562.8 $1,855.3 Cost Of Goods Sold Llul $10,239.2 $12,199.6 $14,417.2 Total Long-Term Assets $28,758 $28,476.5 $26,175.3 Llul $10,786 $10,620.8 $10,204.7 Gross Profit Llul $32,811.2 $33,803.7 $31,023.9 Total Assets Research And Development Expenses Llul $2,973.5 $2,890.6 $3,468.3 Total Current Liabilities SG&A Expenses $2,200.2 $2,231.3 $2,384.5 Llil $31,075.3 $29,536.4 $25,878.5 Long Term Debt Other Operating Income Or Expenses $236.8 $1,163.2 $-75.7 Llul $3,177.5 $3,525.3 $2,064.3 Other Non-Current Liabilities $16,877.4 Operating Expenses $12,202.6 $13,267.7 Lll Total Long Term Liabilities $36,096.1 $34,181.1 $29,759.9 Lll Operating Income $8,822.599 $9,552.701 $7,744.502 Lll $39,069.6 $37,071.7 $33,228.2 Total Liabilities Lll Total Non-Operating Income/Expense $-1,006.5 $-979.2 $-878.5 Lll $16.6 $16.6 $16.6 Common Stock Net $7,816.1 $8,573.5 $6,866 Pre-Tax Income Lll $50,487 $48,325.8 $46,222.7 Retained Earnings (Accumulated Deficit) Lll Income Taxes $1,891.8 $3,381.2 $2,179.5 $-2,609.5 $-2,178.4 $-3,092.9 Comprehensive Income Llul $5,924.3 $5,192.3 $4,686.5 Income After Taxes Other Share Holders Equity Other Income Llul $-2,204.3 Share Holder Equity $-6,258.4 $-3,268 Llul $5,924.3 $5,192.3 $4,686.5 Income From Continuous Operations Lll Total Liabilities And Share Holders Equity $32,811.2 $33,803.7 $31,023.9 Income From Discontinued Operations Net Income $5,924.3 $5,192.3 $4,686.5 EBITDA $9,261.002 $10,304.6 $10,916.1 EBIT $8,822.599 $9,552.701 $7,744.502 Basic Shares Outstanding Lll 778 807 854 Shares Outstanding 786 816 861 Llul $7.61 $6.43 $5.49 Basic EPS Llul $5.44 $7.54 $6.37 EPS - Earnings Per Share 3333333333

McDonalds Annual Data | Millions of US $ except per share data 2016-12-31 2018-12-31 2017-12-31 2017-12-31 Annual Data 2018-12-31 Llal Net Income/Los $5,924.3 $5,192.3 $4,686.5 Llul Lll $1,482 $1,363.4 $1,516.5 1.3631 Total Depreciation And Amortization - Cash Flow 1.8429 Current Ratio Llul Lal $33.1 $-24 $-310.4 Long-term Debt / Capital Other Non-Cash Items 1.2522 1.1244 Llal Lll $1,515.1 $1,339.4 $1,206.1 Total Non-Cash Items Debt/Equity Ratio -4.9654 -9.0381 Change In Accounts Receivable Lll Lll $-479.4 $-340.7 $-159 Gross Margin 51.3003 46.5408 Llal $-1.9 $-37.3 Change In Inventories $28.1 Operating Margin 41.962 41.8604 Llil EBIT Margin $129.4 $-59.7 $89.8 Change In Accounts Payable 41.8604 41.962 Change In Assets/Liabilities Lll EBITDA Margin 49.0107 47.8348 $-980.5 Total Change In Assets/Liabilities $167 Pre-Tax Profit Margin 37.5695 $-472.7 37.1749 Llal $6,966.7 $5,551.2 $6,059.6 Net Profit Margin 22.7529 Cash Flow From Operating Activities 28.1771 Llul S-2,581.3 $-1,686.9 $-1,738.2 Net Change In Property, Plant, And Equipment 0.6408 Asset Turnover 0.6751 Net Change In Intangible Assets Inventory Turnover Ratio 200.3757 207.4762 $429.1 $2,494.8 $866.1 Net Acquisitions/Divestitures 11.5476 Receiveable Turnover 8.6116 Net Change In Short-term Investments Days Sales In Receivables 42.3847 31.6083 Llal Net Change In Long-Term Investments ROE - Return On Equity Lll -94.6616 -158.8832 Lll Return On Tangible Equity Net Change In Investments - Total -68.9682 -91.9365 Lll ROA - Return On Assets $-109.5 $-302.9 $-245.9 Investing Activities - Other 18.0557 15.3602 Llal ROI - Return On Investment Cash Flow From Investing Activities $-2,455.1 $562 $-981.6 23.872 19.7663 Net Long-Term Debt $2,034.9 $3,078.1 $2,956.6 Book Value Per Share -8.1585 -4.4517 Net Current Debt $95.9 $-1,050.3 $-286.2 Operating Cash Flow Per Share 8.868 6.8071 Debt Issuance/Retirement Net - Total Llul $2,130.8 Lll $2,027.8 $2,670.4 5.5822 4.7386 Free Cash Flow Per Share Llal $-4,804.5 $-4,228.9 $-10,871.6 Net Common Equity Issued/Repurchased Net Total Equity Issued/Repurchased S-4,804.5 $-4,228.9 $-10,871.6 Llal $-3,255.9 $-3,089.2 S-3,058.2 Total Common And Preferred Stock Dividends Paid Annual Data | Millions of US $ except per share data 2017-12-31 2018-12-31 2016-12-31 Lll $-20.5 $-20 $-3 Financial Activities - Other Cash On Hand $866 $2,463.8 $1,223.4 Llal $-5,949.6 $-5,310.8 $-11,262.4 Cash Flow From Financial Activities Notes And Loans Receivable Llal $-1,597.8 $1,240.4 $-6,462.1 Net Cash Flow $51.1 $58.8 $58.9 Inventory Lll $125.1 Stock-Based Compensation $117.5 $131.3 $1,527 Other Current Assets $-3,255.9 $-3,089.2 $-3,058.2 Common Stock Dividends Paid Llil $4,053.2 $5,327.2 $4,848.6 Total Current Assets Llal Property, Plant, And Equipment $22,842.7 $22,448.3 $21,257.6 Annual Data | Millions of US $ except per share data 2018-12-31 2016-12-31 Lll 2017-12-31 $725.9 Long-Term Investments $1,202.8 $1,085.7 Lll Goodwill And Intangible Assets $2,331.5 $2,379.7 $2,336.5 Llul $22,820.4 $21,025.2 $24,621.9 Revenue Llul Other Long-Term Assets $2,381 $2,562.8 $1,855.3 Cost Of Goods Sold Llul $10,239.2 $12,199.6 $14,417.2 Total Long-Term Assets $28,758 $28,476.5 $26,175.3 Llul $10,786 $10,620.8 $10,204.7 Gross Profit Llul $32,811.2 $33,803.7 $31,023.9 Total Assets Research And Development Expenses Llul $2,973.5 $2,890.6 $3,468.3 Total Current Liabilities SG&A Expenses $2,200.2 $2,231.3 $2,384.5 Llil $31,075.3 $29,536.4 $25,878.5 Long Term Debt Other Operating Income Or Expenses $236.8 $1,163.2 $-75.7 Llul $3,177.5 $3,525.3 $2,064.3 Other Non-Current Liabilities $16,877.4 Operating Expenses $12,202.6 $13,267.7 Lll Total Long Term Liabilities $36,096.1 $34,181.1 $29,759.9 Lll Operating Income $8,822.599 $9,552.701 $7,744.502 Lll $39,069.6 $37,071.7 $33,228.2 Total Liabilities Lll Total Non-Operating Income/Expense $-1,006.5 $-979.2 $-878.5 Lll $16.6 $16.6 $16.6 Common Stock Net $7,816.1 $8,573.5 $6,866 Pre-Tax Income Lll $50,487 $48,325.8 $46,222.7 Retained Earnings (Accumulated Deficit) Lll Income Taxes $1,891.8 $3,381.2 $2,179.5 $-2,609.5 $-2,178.4 $-3,092.9 Comprehensive Income Llul $5,924.3 $5,192.3 $4,686.5 Income After Taxes Other Share Holders Equity Other Income Llul $-2,204.3 Share Holder Equity $-6,258.4 $-3,268 Llul $5,924.3 $5,192.3 $4,686.5 Income From Continuous Operations Lll Total Liabilities And Share Holders Equity $32,811.2 $33,803.7 $31,023.9 Income From Discontinued Operations Net Income $5,924.3 $5,192.3 $4,686.5 EBITDA $9,261.002 $10,304.6 $10,916.1 EBIT $8,822.599 $9,552.701 $7,744.502 Basic Shares Outstanding Lll 778 807 854 Shares Outstanding 786 816 861 Llul $7.61 $6.43 $5.49 Basic EPS Llul $5.44 $7.54 $6.37 EPS - Earnings Per Share 3333333333

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Using the financial statements in the image, calculate the following ratios for both the FY 2017 and FY 2018:

- Current Ratio

- Quick Ratio

- Total Asset Turnover

- Average Collection

- Total Debt to Total Assets

- Times Interest Earned

- Net Profit Margin

Return on Assets Return on Equity - Modified Du Point Equation for FY 2018

- PE Ratio

- Market to Book Ratio

Transcribed Image Text:McDonalds

Annual Data | Millions of US $ except per share data

2016-12-31

2018-12-31

2017-12-31

2017-12-31

Annual Data

2018-12-31

Llal

Net Income/Los

$5,924.3

$5,192.3

$4,686.5

Llul

Lll

$1,482

$1,363.4

$1,516.5

1.3631

Total Depreciation And Amortization - Cash Flow

1.8429

Current Ratio

Llul

Lal

$33.1

$-24

$-310.4

Long-term Debt / Capital

Other Non-Cash Items

1.2522

1.1244

Llal

Lll

$1,515.1

$1,339.4

$1,206.1

Total Non-Cash Items

Debt/Equity Ratio

-4.9654

-9.0381

Change In Accounts Receivable

Lll

Lll

$-479.4

$-340.7

$-159

Gross Margin

51.3003

46.5408

Llal

$-1.9

$-37.3

Change In Inventories

$28.1

Operating Margin

41.962

41.8604

Llil

EBIT Margin

$129.4

$-59.7

$89.8

Change In Accounts Payable

41.8604

41.962

Change In Assets/Liabilities

Lll

EBITDA Margin

49.0107

47.8348

$-980.5

Total Change In Assets/Liabilities

$167

Pre-Tax Profit Margin

37.5695

$-472.7

37.1749

Llal

$6,966.7

$5,551.2

$6,059.6

Net Profit Margin

22.7529

Cash Flow From Operating Activities

28.1771

Llul

S-2,581.3

$-1,686.9

$-1,738.2

Net Change In Property, Plant, And Equipment

0.6408

Asset Turnover

0.6751

Net Change In Intangible Assets

Inventory Turnover Ratio

200.3757

207.4762

$429.1

$2,494.8

$866.1

Net Acquisitions/Divestitures

11.5476

Receiveable Turnover

8.6116

Net Change In Short-term Investments

Days Sales In Receivables

42.3847

31.6083

Llal

Net Change In Long-Term Investments

ROE - Return On Equity

Lll

-94.6616

-158.8832

Lll

Return On Tangible Equity

Net Change In Investments - Total

-68.9682

-91.9365

Lll

ROA - Return On Assets

$-109.5

$-302.9

$-245.9

Investing Activities - Other

18.0557

15.3602

Llal

ROI - Return On Investment

Cash Flow From Investing Activities

$-2,455.1

$562

$-981.6

23.872

19.7663

Net Long-Term Debt

$2,034.9

$3,078.1

$2,956.6

Book Value Per Share

-8.1585

-4.4517

Net Current Debt

$95.9

$-1,050.3

$-286.2

Operating Cash Flow Per Share

8.868

6.8071

Debt Issuance/Retirement Net - Total

Llul

$2,130.8

Lll

$2,027.8

$2,670.4

5.5822

4.7386

Free Cash Flow Per Share

Llal

$-4,804.5

$-4,228.9

$-10,871.6

Net Common Equity Issued/Repurchased

Net Total Equity Issued/Repurchased

S-4,804.5

$-4,228.9

$-10,871.6

Llal

$-3,255.9

$-3,089.2

S-3,058.2

Total Common And Preferred Stock Dividends Paid

Annual Data | Millions of US $ except per share data

2017-12-31

2018-12-31

2016-12-31

Lll

$-20.5

$-20

$-3

Financial Activities - Other

Cash On Hand

$866

$2,463.8

$1,223.4

Llal

$-5,949.6

$-5,310.8

$-11,262.4

Cash Flow From Financial Activities

Notes And Loans Receivable

Llal

$-1,597.8

$1,240.4

$-6,462.1

Net Cash Flow

$51.1

$58.8

$58.9

Inventory

Lll

$125.1

Stock-Based Compensation

$117.5

$131.3

$1,527

Other Current Assets

$-3,255.9

$-3,089.2

$-3,058.2

Common Stock Dividends Paid

Llil

$4,053.2

$5,327.2

$4,848.6

Total Current Assets

Llal

Property, Plant, And Equipment

$22,842.7

$22,448.3

$21,257.6

Annual Data | Millions of US $ except per share data

2018-12-31

2016-12-31

Lll

2017-12-31

$725.9

Long-Term Investments

$1,202.8

$1,085.7

Lll

Goodwill And Intangible Assets

$2,331.5

$2,379.7

$2,336.5

Llul

$22,820.4

$21,025.2

$24,621.9

Revenue

Llul

Other Long-Term Assets

$2,381

$2,562.8

$1,855.3

Cost Of Goods Sold

Llul

$10,239.2

$12,199.6

$14,417.2

Total Long-Term Assets

$28,758

$28,476.5

$26,175.3

Llul

$10,786

$10,620.8

$10,204.7

Gross Profit

Llul

$32,811.2

$33,803.7

$31,023.9

Total Assets

Research And Development Expenses

Llul

$2,973.5

$2,890.6

$3,468.3

Total Current Liabilities

SG&A Expenses

$2,200.2

$2,231.3

$2,384.5

Llil

$31,075.3

$29,536.4

$25,878.5

Long Term Debt

Other Operating Income Or Expenses

$236.8

$1,163.2

$-75.7

Llul

$3,177.5

$3,525.3

$2,064.3

Other Non-Current Liabilities

$16,877.4

Operating Expenses

$12,202.6

$13,267.7

Lll

Total Long Term Liabilities

$36,096.1

$34,181.1

$29,759.9

Lll

Operating Income

$8,822.599

$9,552.701

$7,744.502

Lll

$39,069.6

$37,071.7

$33,228.2

Total Liabilities

Lll

Total Non-Operating Income/Expense

$-1,006.5

$-979.2

$-878.5

Lll

$16.6

$16.6

$16.6

Common Stock Net

$7,816.1

$8,573.5

$6,866

Pre-Tax Income

Lll

$50,487

$48,325.8

$46,222.7

Retained Earnings (Accumulated Deficit)

Lll

Income Taxes

$1,891.8

$3,381.2

$2,179.5

$-2,609.5

$-2,178.4

$-3,092.9

Comprehensive Income

Llul

$5,924.3

$5,192.3

$4,686.5

Income After Taxes

Other Share Holders Equity

Other Income

Llul

$-2,204.3

Share Holder Equity

$-6,258.4

$-3,268

Llul

$5,924.3

$5,192.3

$4,686.5

Income From Continuous Operations

Lll

Total Liabilities And Share Holders Equity

$32,811.2

$33,803.7

$31,023.9

Income From Discontinued Operations

Net Income

$5,924.3

$5,192.3

$4,686.5

EBITDA

$9,261.002

$10,304.6

$10,916.1

EBIT

$8,822.599

$9,552.701

$7,744.502

Basic Shares Outstanding

Lll

778

807

854

Shares Outstanding

786

816

861

Llul

$7.61

$6.43

$5.49

Basic EPS

Llul

$5.44

$7.54

$6.37

EPS - Earnings Per Share

3333333333

Expert Solution

Step 1

Ratio analysis is a tool used by the various people to analyze the financial statement of a company. There are various ratios which helps an investor, managers and public to assess the company’s operational efficiency, profitability along with its liquidity position in the existing market.

Given Information: Financial statement of Company MD.

Step 2

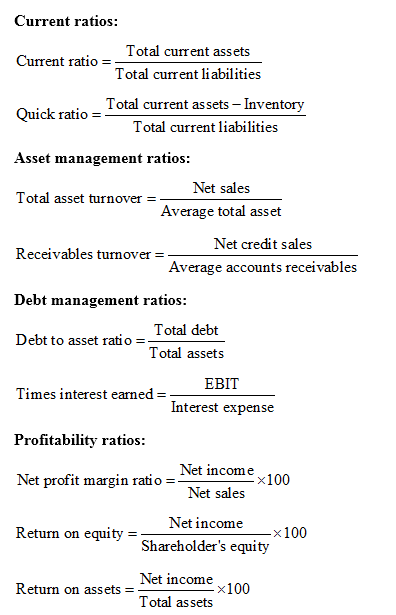

Formulae used to calculate financial ratios:

Step 3

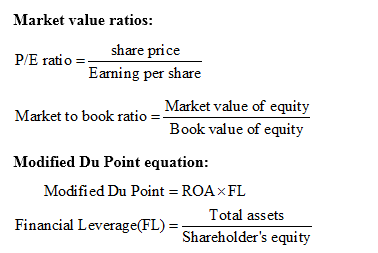

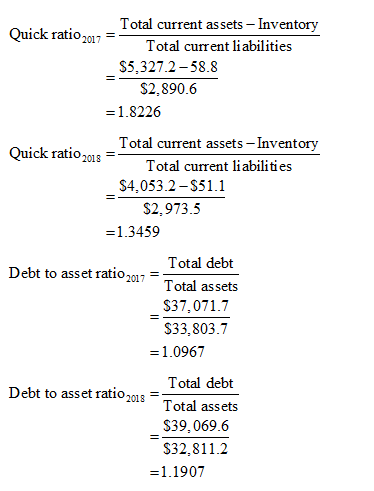

Calculations:

Some of the ratios are given for which calculations are not shown. The rest of the ratios are calculated as follows:

Step 4

Step by step

Solved in 7 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education