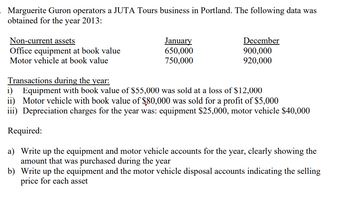

Marguerite Guron operators a JUTA Tours business in Portland. The following data was obtained for the year 2013: Non-current assets Office equipment at book value Motor vehicle at book value January 650,000 750,000 December 900,000 920,000 Transactions during the year: 1) Equipment with book value of $55,000 was sold at a loss of $12,000 ii) Motor vehicle with book value of $80,000 was sold for a profit of $5,000 iii) Depreciation charges for the year was: equipment $25,000, motor vehicle $40,000 Required: a) Write up the equipment and motor vehicle accounts for the year, clearly showing the amount that was purchased during the year b) Write up the equipment and the motor vehicle disposal accounts indicating the selling price for each asset

Marguerite Guron operators a JUTA Tours business in Portland. The following data was obtained for the year 2013: Non-current assets Office equipment at book value Motor vehicle at book value January 650,000 750,000 December 900,000 920,000 Transactions during the year: 1) Equipment with book value of $55,000 was sold at a loss of $12,000 ii) Motor vehicle with book value of $80,000 was sold for a profit of $5,000 iii) Depreciation charges for the year was: equipment $25,000, motor vehicle $40,000 Required: a) Write up the equipment and motor vehicle accounts for the year, clearly showing the amount that was purchased during the year b) Write up the equipment and the motor vehicle disposal accounts indicating the selling price for each asset

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. We've credited a question to your account.

Your Question:

Please do not give solution in image format thanku

Transcribed Image Text:Marguerite Guron operators a JUTA Tours business in Portland. The following data was

obtained for the year 2013:

Non-current assets

Office equipment at book value

Motor vehicle at book value

January

650,000

750,000

December

900,000

920,000

Transactions during the year:

1) Equipment with book value of $55,000 was sold at a loss of $12,000

ii) Motor vehicle with book value of $80,000 was sold for a profit of $5,000

iii) Depreciation charges for the year was: equipment $25,000, motor vehicle $40,000

Required:

a) Write up the equipment and motor vehicle accounts for the year, clearly showing the

amount that was purchased during the year

b) Write up the equipment and the motor vehicle disposal accounts indicating the selling

price for each asset

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education