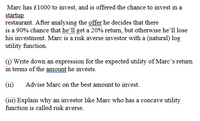

Marc has £1000 to invest, and is offered the chance to invest in a startup restaurant. After analysing the offer he decides that there is a 90% chance that he'll get a 20% return, but otherwise he'll lose his investment. Marc is a risk averse investor with a (natural) log utility function. i) Write down an expression for the expected utility of Marc's return in terms of the amount he invests. (ii) Advise Marc on the best amount to invest. (iii) Explain why an investor like Marc who has a concave utility function is called risk averse.

Marc has £1000 to invest, and is offered the chance to invest in a startup restaurant. After analysing the offer he decides that there is a 90% chance that he'll get a 20% return, but otherwise he'll lose his investment. Marc is a risk averse investor with a (natural) log utility function. i) Write down an expression for the expected utility of Marc's return in terms of the amount he invests. (ii) Advise Marc on the best amount to invest. (iii) Explain why an investor like Marc who has a concave utility function is called risk averse.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Hi and thanks for your question! Unfortunately we cannot answer this particular question due to its complexity.

We've credited a question back to your account. Apologies for the inconvenience.

Your Question:

Transcribed Image Text:Marc has £1000 to invest, and is offered the chance to invest in a

startup

restaurant. After analysing the offer he decides that there

is a 90% chance that he'll get a 20% return, but otherwise he'll lose

his investment. Marc is a risk averse investor with a (natural) log

utility function.

i) Write down an expression for the expected utility of Marc's return

in terms of the amount he invests.

(ii)

Advise Marc on the best amount to invest.

(iii) Explain why an investor like Marc who has a concave utility

function is called risk averse.

Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning