LB Enterprises (LB) is preparing its budget for the first quarter of 2019. LB's balance sheet as of December 31, 2018 is as follows: Assets Liabilities Cash $5,000 Accounts Payable $9500 Accounts Recievable 28,000 Inventories Direct Materials 8,100 Finished Goods (500 Units) 16,870 Stockholders Equity Equipment - gross 45,000 Accumulated depreciation 15.000 Common Stock $15,000 Net Equipment 30,000 Retained Earnings 63,470 Total Assets $87,970 Total Liabilities and $87,960 Equity LB sells one product for $45/unit. The Company forecasts that it will sell 2,000; 1,500; 1,600; and 1,700 units in January, February, March and April, respectively. • Sales to customers are all on credit. 40% of the cash for these sales is collected in the month of the sale and the remaining 60% is collected in the following month. LB wants finished goods inventory equal to 25% of the next month's sales on hand at the end of each month. LB wants direct materials equal to 75% of the current month's production requirements on hand at the end of each month. Each unit of finished goods inventory requires 2.5 pound of direct materials at $3 per pound and 2 hours of direct labor at $10.00 per hour. Direct material purchases are paid 15% in the month they are purchased and 85% in the following month. All other costs of the company are paid for as they are incurred. Manufacturing Overhead consists of the following o Indirect Materials (S.15/unit) o Indirect Labor (S.40/unit) Other ($.35/unit) Production supervisors' salaries - $6,000 per month Depreciation - $950 per month Other fixed - $2,000 per month Selling and Adminitstraion costs consist of the following Commissions ($1.10/unit sold) Freight (S.15/unit sold) Salaries - $8,500 per month Rent - $800 per month Depreciation $150 per month LB will purchase new equipment at a cost of $10,000 on March 31, 2019 5. What is the expected balance in Accounts Payable on March 31, 2019 (the end of the quarter)? A) $1,913 B) $ 10,838 C) $ 14,033 D) $ 8,256

LB Enterprises (LB) is preparing its budget for the first quarter of 2019. LB's balance sheet as of December 31, 2018 is as follows: Assets Liabilities Cash $5,000 Accounts Payable $9500 Accounts Recievable 28,000 Inventories Direct Materials 8,100 Finished Goods (500 Units) 16,870 Stockholders Equity Equipment - gross 45,000 Accumulated depreciation 15.000 Common Stock $15,000 Net Equipment 30,000 Retained Earnings 63,470 Total Assets $87,970 Total Liabilities and $87,960 Equity LB sells one product for $45/unit. The Company forecasts that it will sell 2,000; 1,500; 1,600; and 1,700 units in January, February, March and April, respectively. • Sales to customers are all on credit. 40% of the cash for these sales is collected in the month of the sale and the remaining 60% is collected in the following month. LB wants finished goods inventory equal to 25% of the next month's sales on hand at the end of each month. LB wants direct materials equal to 75% of the current month's production requirements on hand at the end of each month. Each unit of finished goods inventory requires 2.5 pound of direct materials at $3 per pound and 2 hours of direct labor at $10.00 per hour. Direct material purchases are paid 15% in the month they are purchased and 85% in the following month. All other costs of the company are paid for as they are incurred. Manufacturing Overhead consists of the following o Indirect Materials (S.15/unit) o Indirect Labor (S.40/unit) Other ($.35/unit) Production supervisors' salaries - $6,000 per month Depreciation - $950 per month Other fixed - $2,000 per month Selling and Adminitstraion costs consist of the following Commissions ($1.10/unit sold) Freight (S.15/unit sold) Salaries - $8,500 per month Rent - $800 per month Depreciation $150 per month LB will purchase new equipment at a cost of $10,000 on March 31, 2019 5. What is the expected balance in Accounts Payable on March 31, 2019 (the end of the quarter)? A) $1,913 B) $ 10,838 C) $ 14,033 D) $ 8,256

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:LB Enterprises (LB) is preparing its budget for the first quarter of 2019. LB's balance sheet as of December 31, 2018

is as follows:

Assets

Liabilities

Cash

$5,000

Accounts Payable

$9500

Accounts Recievable

28,000

Inventories

Direct Materials

8,100

Finished Goods (500

Units)

16,870

Stockholders Equity

Equipment - gross

45,000

Accumulated depreciation

15.000

Common Stock

$15,000

Net Equipment

30,000

Retained Earnings

63,470

Total Assets

$87,970

Total Liabilities and

$87,960

Equity

LB sells one product for $45/unit. The Company forecasts that it will sell 2,000; 1,500; 1,600; and 1,700 units

in January, February, March and April, respectively.

• Sales to customers are all on credit. 40% of the cash for these sales is collected in the month of the sale and

the remaining 60% is collected in the following month.

LB wants finished goods inventory equal to 25% of the next month's sales on hand at the end of each

month.

LB wants direct materials equal to 75% of the current month's production requirements on hand at the end

of each month.

Each unit of finished goods inventory requires 2.5 pound of direct materials at $3 per pound and 2 hours of

direct labor at $10.00 per hour.

Direct material purchases are paid 15% in the month they are purchased and 85% in the following month. All

other costs of the company are paid for as they are incurred.

Manufacturing Overhead consists of the following

o Indirect Materials (S.15/unit)

o Indirect Labor (S.40/unit)

Other ($.35/unit)

Production supervisors' salaries - $6,000 per month

Depreciation - $950 per month

Other fixed - $2,000 per month

Selling and Adminitstraion costs consist of the following

Commissions ($1.10/unit sold)

Freight (S.15/unit sold)

Salaries - $8,500 per month

Rent - $800 per month

Depreciation $150 per month

LB will purchase new equipment at a cost of $10,000 on March 31, 2019

Transcribed Image Text:5. What is the expected balance in Accounts Payable on March 31, 2019 (the end of the

quarter)?

A) $1,913

B) $ 10,838

C) $ 14,033

D) $ 8,256

Expert Solution

Step 1

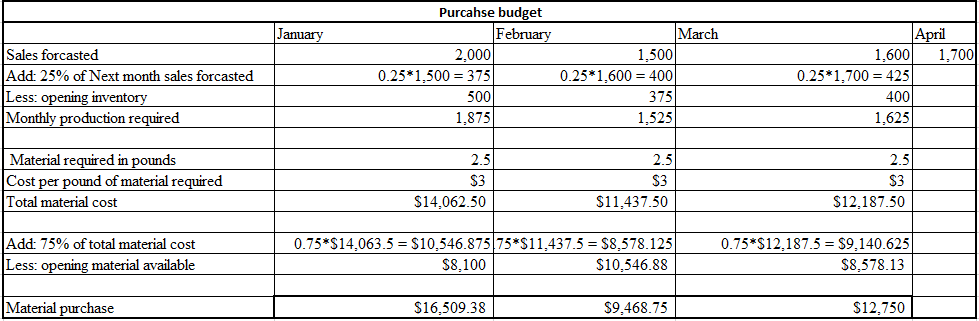

The material purchase of the march of $12,750 is computed by adding 75% of total material cost, $9,140 and subtracting opening material available, $8,578.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education