LB Enterprises (LB) is preparing its budget for the first quarter of 2019. LB's balance sheet as of December 31, 2018 is as follows: Assets Liabilities Cash $5,000 Accounts Payable $9500 Accounts Recievable 28,000 Inventories Direct Materials 8,100 Finished Goods (500 Units) 16,870 Stockholders Equity Equipment - gross 45,000 Accumulated depreciation 15.000 Common Stock $15,000 Net Equipment 30,000 Retained Earnings 63,470 Total Assets $87,970 Total Liabilities and $87,960 Equity LB sells one product for $45/unit. The Company forecasts that it will sell 2,000; 1,500; 1,600; and 1,700 units in January, February, March and April, respectively. • Sales to customers are all on credit. 40% of the cash for these sales is collected in the month of the sale and the remaining 60% is collected in the following month. LB wants finished goods inventory equal to 25% of the next month's sales on hand at the end of each month. LB wants direct materials equal to 75% of the current month's production requirements on hand at the end of each month. Each unit of finished goods inventory requires 2.5 pound of direct materials at $3 per pound and 2 hours of direct labor at $10.00 per hour. Direct material purchases are paid 15% in the month they are purchased and 85% in the following month. All other costs of the company are paid for as they are incurred. Manufacturing Overhead consists of the following o Indirect Materials (S.15/unit) o Indirect Labor (S.40/unit) Other ($.35/unit) Production supervisors' salaries - $6,000 per month Depreciation - $950 per month Other fixed - $2,000 per month Selling and Adminitstraion costs consist of the following Commissions ($1.10/unit sold) Freight (S.15/unit sold) Salaries - $8,500 per month Rent - $800 per month Depreciation $150 per month LB will purchase new equipment at a cost of $10,000 on March 31, 2019 6. What is the expected balance in Direct Materials at March 31, 2019. A) $ 8,802 B) $ 12,750 C) $ 9,141 D) $ 8,100

Direct material purchase budget determines the measure of direct materials that must be purchased by an organization in order to meet the units to be produced.

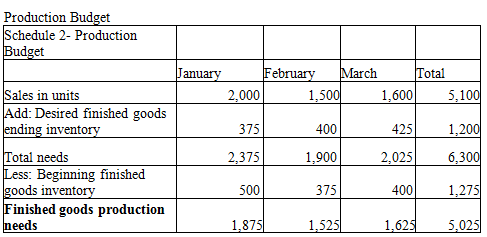

Formula to calculate budgeted production units=

Budgeted unit sales + Budgeted ending finished goods - Budgeted beginning finished inventory

Notes:

- Ending inventory for every month is calculated as 25% of next month sales.

- The ending value of finished goods inventory becomes the beginning finished inventory for next quarter.

- March= 0.25 of 1,700 (sales of April)

Budgeted production units for March= 1,625

Production needs for direct material= 1,625 × 2.5= 4,063

Ending units of budgeted material for March= 75% of Production need for direct material

= 75% of 4,063

= 3,047

Expected bal. in direct material at the end of 31st March= 3,047 × 3= $9,141

Step by step

Solved in 3 steps with 1 images