Lauren is the proud mother of a new baby girl and plans tosend her daughter to college 19 years from now. Lauren wants tomake a deposit each summer in a special account at her bank whichpays 8% (compounded annually) so that she will have enough moneyset aside that she can withdraw $21,000 at the beginning of eachyear to pay tuition, room and board, etc., for each year of herfour-year education. How much will Lauren have to deposit at theend of each year in order to have enough to pay for her daughter's education?

Lauren is the proud mother of a new baby girl and plans tosend her daughter to college 19 years from now. Lauren wants tomake a deposit each summer in a special account at her bank whichpays 8% (compounded annually) so that she will have enough moneyset aside that she can withdraw $21,000 at the beginning of eachyear to pay tuition, room and board, etc., for each year of herfour-year education. How much will Lauren have to deposit at theend of each year in order to have enough to pay for her daughter's education?

L will send her daughter to college in 19 years. Her daughter will withdraw $21,000 at the beginning of each year for four years. Hence, she will withdraw from year 19 (at the end of year 19 that is beginning of next year).

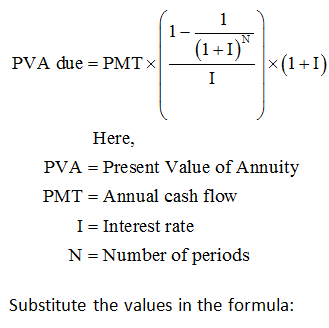

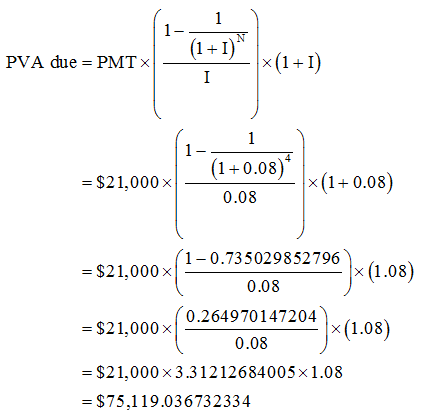

Calculation of present value of annual withdrawals (present value at time year 19) using the present value of annuity due formula:

This is the present value of four annual withdrawals by time year 19. Hence, this is the future value for year 0.

Step by step

Solved in 3 steps with 3 images