Larkspur Furniture uses a perpetual inventory system and pays GST on an accrual basis. Larkspur engaged in the following transactions during July 2021. Transactions are inclusive of GST where relevant.

Larkspur Furniture uses a perpetual inventory system and pays GST on an accrual basis. Larkspur engaged in the following transactions during July 2021. Transactions are inclusive of GST where relevant.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

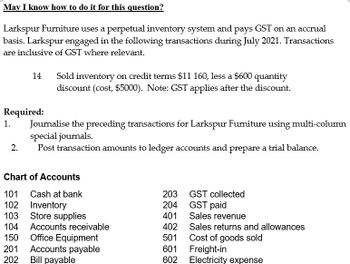

Transcribed Image Text:May I know how to do it for this question?

Larkspur Furniture uses a perpetual inventory system and pays GST on an accrual

basis. Larkspur engaged in the following transactions during July 2021. Transactions

are inclusive of GST where relevant.

14

Required:

1.

2.

Sold inventory on credit terms $11 160, less a $600 quantity

discount (cost, $5000). Note: GST applies after the discount.

Journalise the preceding transactions for Larkspur Furniture using multi-column

special journals.

Post transaction amounts to ledger accounts and prepare a trial balance.

Chart of Accounts

101 Cash at bank

102 Inventory

103

Store supplies

104 Accounts receivable

150

201

202

Office Equipment

Accounts payable

Bill payable

203

204

401

GST collected

GST paid

Sales revenue

Sales returns and allowances

Cost of goods sold

402

501

601

Freight-in

602 Electricity expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

HI, may i know why didn't record cost , $5000?

Transcribed Image Text:May I know how to do it for this question?

Larkspur Furniture uses a perpetual inventory system and pays GST on an accrual

basis. Larkspur engaged in the following transactions during July 2021. Transactions

are inclusive of GST where relevant.

14

Required:

1.

2.

Sold inventory on credit terms $11 160, less a $600 quantity

discount (cost, $5000). Note: GST applies after the discount.

Journalise the preceding transactions for Larkspur Furniture using multi-column

special journals.

Post transaction amounts to ledger accounts and prepare a trial balance.

Chart of Accounts

101 Cash at bank

102 Inventory

103

Store supplies

104 Accounts receivable

150

201

202

Office Equipment

Accounts payable

Bill payable

203

204

401

GST collected

GST paid

Sales revenue

Sales returns and allowances

Cost of goods sold

402

501

601

Freight-in

602 Electricity expense

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education