Johnson company’s financial year ended on December 31, 2010. All the transactions related to the company’s uncollectible accounts are can be found below: January 15 Wrote off $440 account of Miller Company as uncollectible April 2nd Re-establish the account of Louisa Teller and record the collection of $1,050 as payment in full for her account which had been written off earlier July 31 Received 40% of the $700 balance owed by William John and wrote off the remainder as uncollectible August 15 Wrote off as uncollectible the accounts of Sherwin Company, $1,700 and V. Vasell $2,200 September 26 Received 25% of the $1,140 owed by Grant Company and wrote off the remainder as uncollectible October 16 Received $741 from M. Fuller in full payment of his account which had been written off earlier as uncollectible December 31 Estimated uncollectible accounts expense for the year to be 1.5% of net credit sales of $521,000 The accounts receivable account had a balance of $114,630 and the beginning balance in the allowance for uncollectible accounts was $6,200. Required: 1. Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to: A. Determine the amount to be charged to uncollectible expense (show your workings for the computation of this figure). B. Prepare the balance sheet extract to show the net realizable value of the Accounts Receivable as at December 31

Johnson company’s financial year ended on December 31, 2010. All the transactions related to the company’s uncollectible accounts are can be found below:

|

January 15 |

Wrote off $440 account of Miller Company as uncollectible |

|

April 2nd |

Re-establish the account of Louisa Teller and record the collection of $1,050 as payment in full for her account which had been written off earlier |

|

July 31 |

Received 40% of the $700 balance owed by William John and wrote off the remainder as uncollectible |

|

August 15 |

Wrote off as uncollectible the accounts of Sherwin Company, $1,700 and V. Vasell $2,200 |

|

September 26 |

Received 25% of the $1,140 owed by Grant Company and wrote off the remainder as uncollectible |

|

October 16 |

Received $741 from M. Fuller in full payment of his account which had been written off earlier as uncollectible |

|

December 31 |

Estimated uncollectible accounts expense for the year to be 1.5% of net credit sales of $521,000 |

The

Required:

1. Assume that the aging of accounts receivable method was used by the company and that $7,050 of the accounts receivable as of December 31 were estimated to be uncollectible. You are now required to:

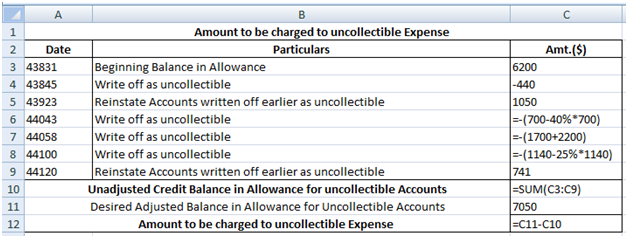

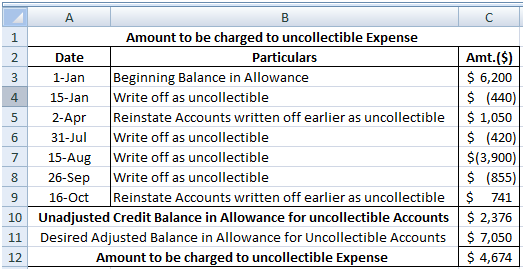

A. Determine the amount to be charged to uncollectible expense (show your workings for the computation of this figure).

B. Prepare the

Amount to be charged to uncollectible expense is shown in excel:

Result is:

Step by step

Solved in 2 steps with 3 images