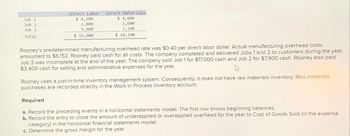

Job 1 Job 2 Job 3 Total Direct Labor $ 4,200 2,800 9,000 $ 16,000 Direct Materials $ 4,800 1,600 3,700 $ 10,100 Rooney's predetermined manufacturing overhead rate was $0.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $6,152. Rooney paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $7,900 cash. Rooney also paid $3,400 cash for selling and administrative expenses for the year. Rooney uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account. Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances. b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold (in the expense category) in the horizontal financial statements model. c. Determine the gross margin for the year.

Job 1 Job 2 Job 3 Total Direct Labor $ 4,200 2,800 9,000 $ 16,000 Direct Materials $ 4,800 1,600 3,700 $ 10,100 Rooney's predetermined manufacturing overhead rate was $0.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $6,152. Rooney paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $7,900 cash. Rooney also paid $3,400 cash for selling and administrative expenses for the year. Rooney uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account. Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances. b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold (in the expense category) in the horizontal financial statements model. c. Determine the gross margin for the year.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Beginning balance information is missing in the question. Please resubmit your question, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Job 1

Job 2

Job 3

Total

Direct Labor

$ 4,200

2,800

9,000

$ 16,000

Direct Materials

$ 4,800

1,600

3,700

$ 10,100

Rooney's predetermined manufacturing overhead rate was $0.40 per direct labor dollar. Actual manufacturing overhead costs

amounted to $6,152. Rooney paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year.

Job 3 was incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $7,900 cash. Rooney also paid

$3,400 cash for selling and administrative expenses for the year.

Rooney uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materials

purchases are recorded directly in the Work in Process Inventory account.

Required

a. Record the preceding events in a horizontal statements model. The first row shows beginning balances.

b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold (in the expense

category) in the horizontal financial statements model.

c. Determine the gross margin for the year.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning