Investigating the principle that all bonds are priced to give the same total yield which is the current market rate of interest. REQUIRED: Create your own bond – i.e. the par value may be kept at 1000, but decide your own coupon rate, maturity period and current market rate of interest. Now compute your total yield which should consist of Current Yield plus Capital Gain/Loss Yield and find out if it equates the market rate of interest that you selected.

Investigating the principle that all

Bonds: Bonds are a debt instrument on which interest is paid. They can be issued at a discount/par or premium.

Present Value of Bonds Payable = Present Value of all interest payments + Present Value of principle returned

Present Value of Bonds Payable = PVIFA (r%, n) * Interest payment + PVIF (r%, n) * principal value

where,

PVIFA = Present Value of Annuity

r = Rate of interest (market)

n = Number of years

PVIF = Present Value

Note:

To get PVIFA (4.5%,10) we look for 4.5% and in that column, we search for 10 in the row and we take the intersection value.

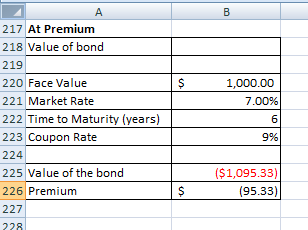

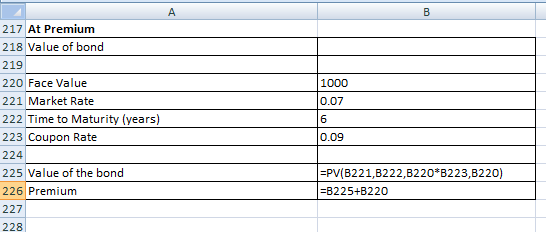

Let our bond be of par value of 1000

Coupon rate: 9% paid annually

Maturity: 6 years

Current Market Rate: 7%

Price of the bond:

Hence, Value of Bond = $1,095.33

Step by step

Solved in 3 steps with 2 images