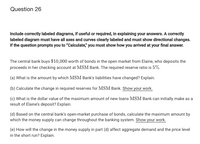

The central bank buys $10,000 worth of bonds in the open market from Elaine, who deposits the proceeds in her checking account at MSM Bank. The required reserve ratio is 5%. (a) What is the amount by which MSM Bank’s liabilities have changed? Explain. (b) Calculate the change in required reserves for MSM Bank. Show your work. (c) What is the dollar value of the maximum amount of new loans MSM Bank can initially make as a result of Elaine’s deposit? Explain. (d) Based on the central bank’s open-market purchase of bonds, calculate the maximum amount by which the money supply can change throughout the banking system. Show your work. (e) How will the change in the money supply in part (d) affect aggregate demand and the price level in the short run? Explain.

The central bank buys $10,000 worth of bonds in the open market from Elaine, who deposits the proceeds in her checking account at MSM Bank. The

(a) What is the amount by which MSM Bank’s liabilities have changed? Explain.

(b) Calculate the change in

(c) What is the dollar value of the maximum amount of new loans MSM Bank can initially make as a result of Elaine’s deposit? Explain.

(d) Based on the central bank’s open-market purchase of bonds, calculate the maximum amount by which the money supply can change throughout the banking system. Show your work.

(e) How will the change in the money supply in part (d) affect aggregate

Trending now

This is a popular solution!

Step by step

Solved in 2 steps