in mutual fund B, the annual return has an expectation standard deviation of $0.03x. Suppose that the returns are independent of each other and that I have $1000 to What are the expectation and variance of my annual r all my money in fund A? What are the expectation and variance of my annual r all my money in fund B? What are the expectation and variance of my total ann invest half of my money in fund A and half in fund B? Suppose I invest $x in fund A and the rest of my mone value of x minimizes the variance of my total annual re Explain why your answers illustrate the importance of investment strategy.

in mutual fund B, the annual return has an expectation standard deviation of $0.03x. Suppose that the returns are independent of each other and that I have $1000 to What are the expectation and variance of my annual r all my money in fund A? What are the expectation and variance of my annual r all my money in fund B? What are the expectation and variance of my total ann invest half of my money in fund A and half in fund B? Suppose I invest $x in fund A and the rest of my mone value of x minimizes the variance of my total annual re Explain why your answers illustrate the importance of investment strategy.

Chapter6: Exponential And Logarithmic Functions

Section6.8: Fitting Exponential Models To Data

Problem 5SE: What does the y -intercept on the graph of a logistic equation correspond to for a population...

Related questions

Question

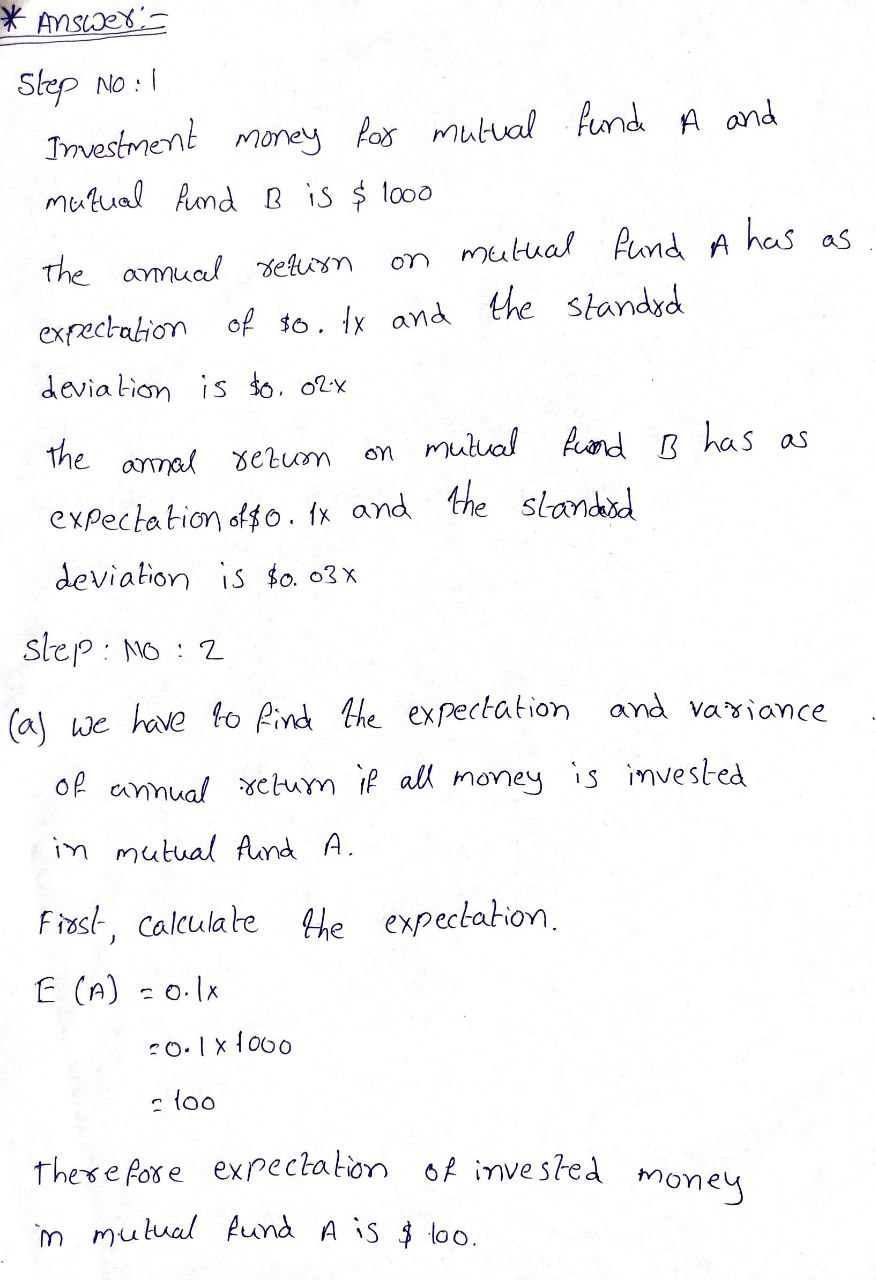

Transcribed Image Text:2.6.11If $x is invested in mutual fund A, the annual return has an

expectation of $0.1x and a standard deviation of $0.02x. If $x is invested

in mutual fund B, the annual return has an expectation of $0.1x and a

standard deviation of $0.03x. Suppose that the returns on the two funds

are independent of each other and that I have $1000 to invest.

(a) What are the expectation and variance of my annual return if I invest

all my money in fund A?

(b) What are the expectation and variance of my annual return if I invest

all my money in fund B?

(c) What are the expectation and variance of my total annual return if I

invest half of my money in fund A and half in fund B?

(d) Suppose I invest $x in fund A and the rest of my money in fund B. What

value of x minimizes the variance of my total annual return?

Explain why your answers illustrate the importance of diversity in an

investment strategy.

Expert Solution

Step 1

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill