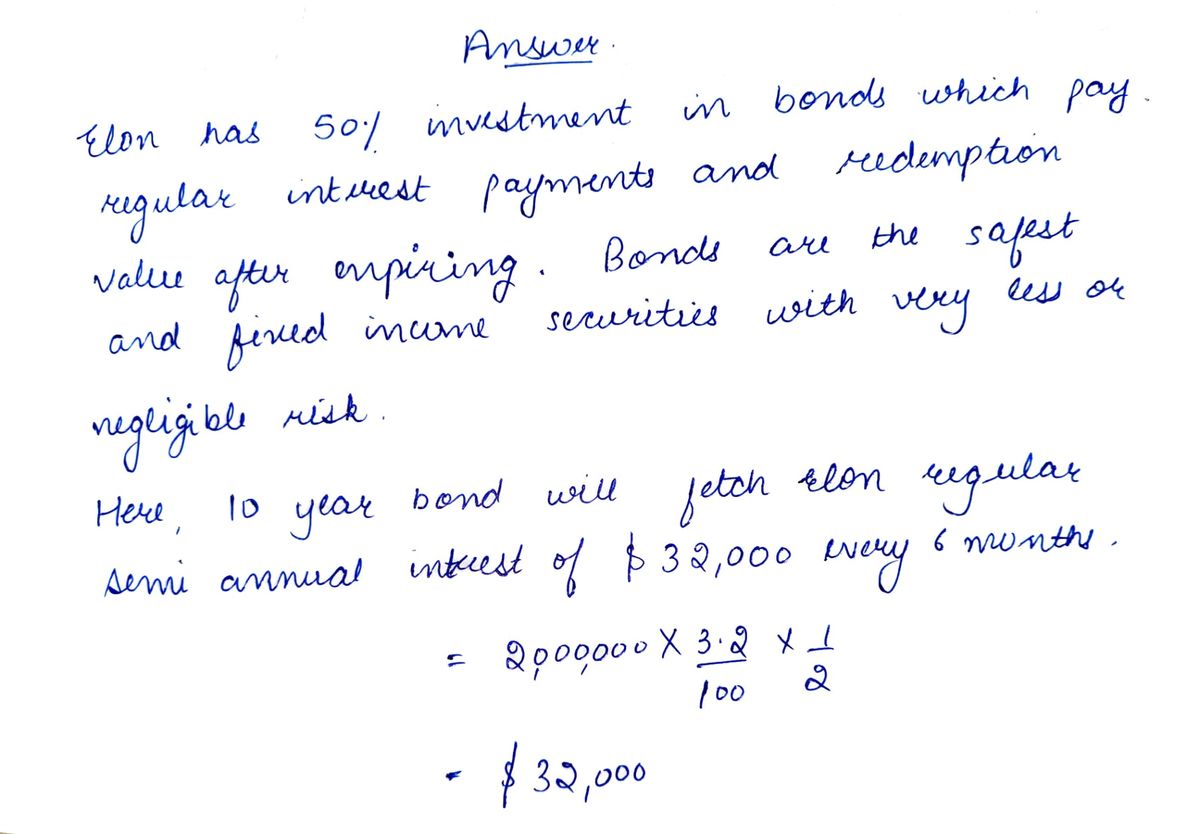

In 2016 Beth purchased a 10-year, 3.20% p.a. semi-annual paying coupon bond with a Face Value (FV) of $2 000 000, as she was attracted by the fixed income stream in order to fund her retirement expenses. d) Elon, a Wall street portfolio manager, informed Beth that she should consider investing in his portfolio instead. He said his portfolio is perfect for someone who is looking to retire within the next 6 MONTHS. His portfolio has the following allocation of assets: Asset Class Allocation Shares in Small Companies (High Risk) 0% Shares in Blue Chip Companies (Low Risk) 20% Bonds 50% Cash 30% Does Elon have a point? Why or why not?

In 2016 Beth purchased a 10-year, 3.20% p.a. semi-annual paying coupon bond with a Face Value (FV) of $2 000 000, as she was attracted by the fixed income stream in order to fund her retirement expenses. d) Elon, a Wall street portfolio manager, informed Beth that she should consider investing in his portfolio instead. He said his portfolio is perfect for someone who is looking to retire within the next 6 MONTHS. His portfolio has the following allocation of assets: Asset Class Allocation Shares in Small Companies (High Risk) 0% Shares in Blue Chip Companies (Low Risk) 20% Bonds 50% Cash 30% Does Elon have a point? Why or why not?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

In 2016 Beth purchased a 10-year, 3.20% p.a. semi-annual paying coupon bond with a Face Value (FV) of $2 000 000, as she was attracted by the fixed income stream in order to fund her retirement expenses.

d) Elon, a Wall street

|

Asset Class |

Allocation |

|

Shares in Small Companies (High Risk) |

0% |

|

Shares in Blue Chip Companies (Low Risk) |

20% |

|

Bonds |

50% |

|

Cash |

30% |

Does Elon have a point? Why or why not?

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education