Identify the most significant cash inflow and outflow activity from Financing activities for the current year.

Identify the most significant cash inflow and outflow activity from Financing activities for the current year.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

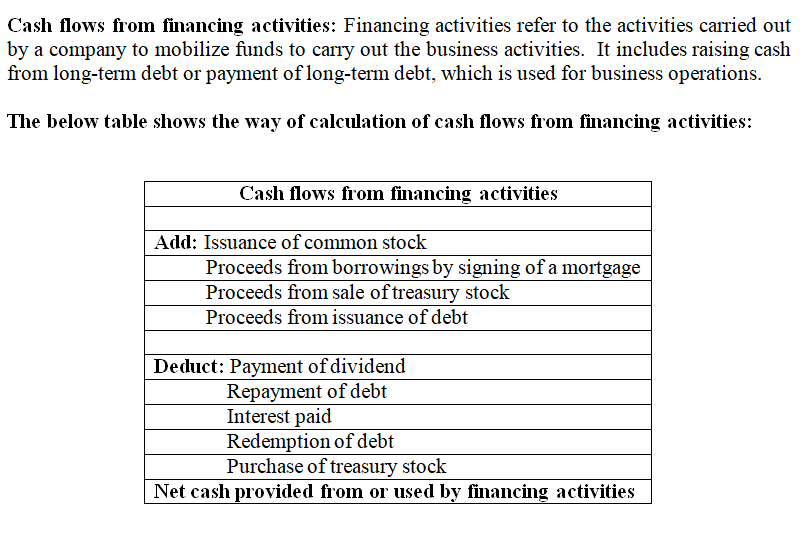

Transcribed Image Text:**Consolidated Statement of Cash Flows**

*In millions*

### Operating Activities

- **Net Income**

- 2019: $6,025.4

- 2018: $5,924.3

- 2017: $5,192.3

- **Adjustments to Reconcile to Cash Provided by Operations**

- **Charges and Credits:**

- Depreciation and Amortization

- 2019: $1,617.9

- 2018: $1,482.0

- 2017: $1,363.4

- Deferred Income Taxes

- 2019: $149.7

- 2018: $102.6

- 2017: $(36.4)

- Share-based Compensation

- 2019: $109.6

- 2018: $125.1

- 2017: $117.5

- Net Gain on Sale of Restaurant Businesses

- 2019: $(128.2)

- 2018: $(308.8)

- 2017: $(1,155.8)

- Other

- 2019: $49.2

- 2018: $114.2

- 2017: $1,050.7

- **Changes in Working Capital Items:**

- Accounts Receivable

- 2019: $27.0

- 2018: $(479.4)

- 2017: $340.7

- Inventories, Prepaid Expenses, and Other Current Assets

- 2019: $128.8

- 2018: $(1.9)

- 2017: $(37.3)

- Accounts Payable

- 2019: $(26.8)

- 2018: $129.4

- 2017: $3.4

- Income Taxes

- 2019: $173.4

- 2018: $(33.4)

- 2017: $(396.4)

- Other Accrued Liabilities

- 2019: $(3.9)

- 2018: $(87.4)

-

Transcribed Image Text:Section V: SCF—Question 5

Identify the most significant cash inflow and outflow activity from Financing activities for the current year.

| Description of Activity | Amount |

|-------------------------|--------|

| Cash inflow: | Click here to enter text. |

| Cash outflow: (Note: cash dividends paid are reported here.) | Click here to enter text. |

This table is designed to document and analyze the cash inflow and outflow related to financing activities for the specified year. The "Cash inflow" section is meant for entering the most significant source of incoming cash from financing activities, while the "Cash outflow" section is for noting the major cash outflow, including dividends paid.

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education