I have 4 problems that I need help finding the correct answer. In each problem an amount for the different categories has been left out so I have to find the unknown number for that account. This is the second time I am submitting these problems for help. The last person not only made numerous typos making it difficult to understand but they also did not reply in a clear manner to each problem. I am labeling the problems 1) 2) 3) and 4). If you could keep that format so it is less confusing I would appreciate it. Also I feel I was given the wrong answer to one of the the problems. So I will see if you come to the same answer.Problem 1Revenue $3000Dividends $2000Expenses $10001/1 Retained Earnings-amount unknown12/31 Retained Earnings $6000Problem 2Revenue $5000Dividends-amount unknownExpenses- $40001/1 Retained Earnings $800012/31 Retained Earnings $3000Problem 3Revenue $6000Dividends $0Expenses-amount unknown1/1 Retained Earnings $1200012/31 Retained Earnings $8000Problem 4Revenue -amount unknownDividends $3000Expenses $60001/1 Retained Earnings $800012/31 Retained Earnings $9000

I have 4 problems that I need help finding the correct answer. In each problem an amount for the different categories has been left out so I have to find the unknown number for that account. This is the second time I am submitting these problems for help. The last person not only made numerous typos making it difficult to understand but they also did not reply in a clear manner to each problem. I am labeling the problems 1) 2) 3) and 4). If you could keep that format so it is less confusing I would appreciate it. Also I feel I was given the wrong answer to one of the the problems. So I will see if you come to the same answer.

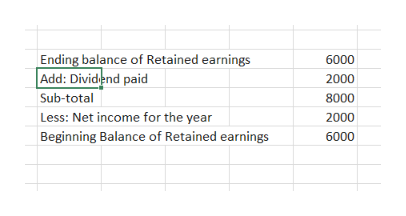

Problem 1

Revenue $3000

Dividends $2000

Expenses $1000

1/1

12/31 Retained Earnings $6000

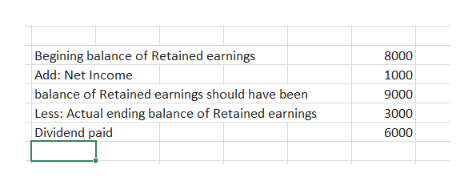

Problem 2

Revenue $5000

Dividends-amount unknown

Expenses- $4000

1/1 Retained Earnings $8000

12/31 Retained Earnings $3000

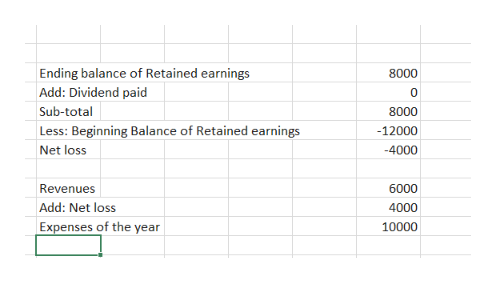

Problem 3

Revenue $6000

Dividends $0

Expenses-amount unknown

1/1 Retained Earnings $12000

12/31 Retained Earnings $8000

Problem 4

Revenue -amount unknown

Dividends $3000

Expenses $6000

1/1 Retained Earnings $8000

12/31 Retained Earnings $9000

Part -1.

In this part, Begining balance of Retained earnings is missing. To compute the same, the first step is to compute the net income earned during the year. This can be computed by deducting the expenses from Total revennues of the year.

Therefore, Net Income = Total revenues - Total expenses =3000-1000 = $ 2000.

Now,

Next step is to reverse calculation of Statement of Retained earnings by adding the dividend paid in the Ending balance of Retained earnings and then deduct the net income (as computed above) from the above sub total to arrive at the amount of beginining balance of Retained earnings.

The Begining Balance of Retained earnings is $ 6000. The same has been computed as above.

part -2. Dividend paid is missing in this part. To compute the same, first step is to compute the net income of the year deducting the expenses from revenues of the year as under:

Net Income = Revenues - Expenses = 5000 -4000 = 1000.

Now,

The next step is to add net income in the begining balance of Retained earnings and the sum is the balance which should have been the ending balance of Retained earnings. But the actual retained earnings is lesser than above sum. Therefore, the difference is dividend paid.

Dividend paid is $ 6000 and the same has been computed as above.

Part -3 Expenses for the year is missing. The first step is to compute the net income for the year by adding dividend paid in the ending balance f Retained earnings and then deducting the begining balance of Retained earnings from sub-total to arrive at the Net income of the year (and if it is negative amount, then it will be expressed as net loss)

The Net loss of the year is (4000).

Now,

The net loss is incurred when the expenses are higher than revenues. Therefore, the expenses is computed by adding net loss in the revenues.

Total expenses of the year is $ 10000 and the same has been computed as above.

Step by step

Solved in 5 steps with 6 images