I am trying to start saving for retirement. I am investing all my cash into the S&P 500, which will assume consistently 9.8% interest, compounded annually. I initially put a lump sum of $100 into my account, and I will deposit $10 every second week. a) After 10 years, how much money will I have invested? b) After 10 years, if I sold all of my stocks, how much money will I have in my account? c) After 25 years, how much money have I invested? d) If I had not sold my stocks at the 10 year mark and instead held onto them an additional 15 years before selling, how much additional money would I have in my account?

I am trying to start saving for retirement. I am investing all my cash into the S&P 500, which will assume consistently 9.8% interest, compounded annually. I initially put a lump sum of $100 into my account, and I will deposit $10 every second week.

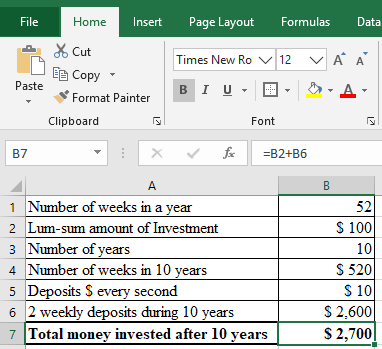

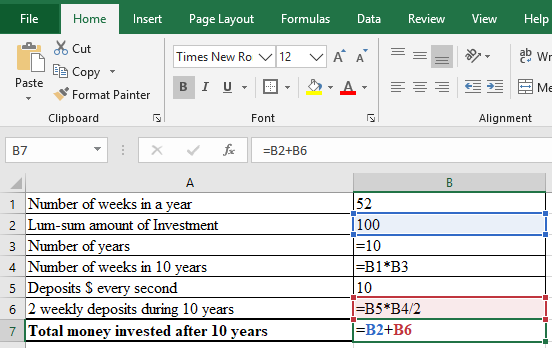

a) After 10 years, how much money will I have invested?

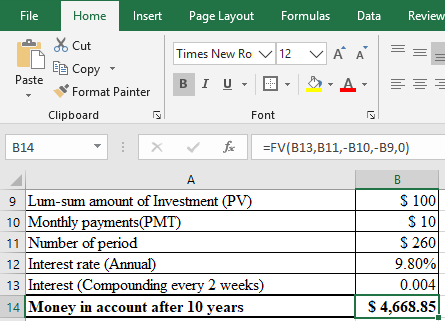

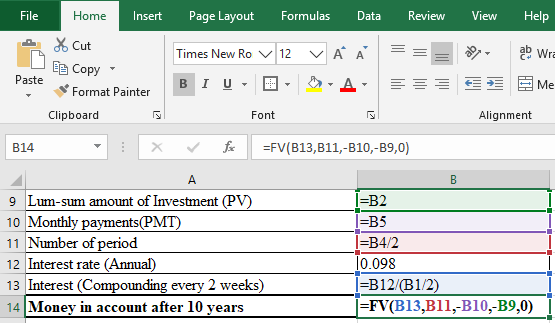

b) After 10 years, if I sold all of my stocks, how much money will I have in my account?

c) After 25 years, how much money have I invested?

d) If I had not sold my stocks at the 10 year mark and instead held onto them an additional 15 years before selling, how much additional money would I have in my account?

a.)

The total money invested after 10 years is computed:

The formula sheet for the above computation:

b.)

The money in the account (after 10 years) is computed:

The formula sheet for the above computation:

Step by step

Solved in 4 steps with 10 images