husband didn’t have any income, can i add him as a dependent ?

Q: Seo and Urban own property as tenants in common. In the event one of them dies, their title will…

A: Lets first understand what is a meaning of tenants in common. When two or more individuals holds…

Q: John is frustrated in his inability to sell his house for the amount he wants. What should Anita do…

A: Competitive market analysis is the analysis which helps in learning from the businesses those are…

Q: (J) Amy is divorced frrom Hector. She does not have any dependents and id no remarry before December…

A: Step 1: Determine Amy's marital status.Amy is divorced, so her marital status is "divorced."Step 2:…

Q: Trudy has just recorded a deed that gives her daughter, Sally, a life estate in the family farm plus…

A: Life estate deed-It is a special deed, under which the owner of the property is allowed to use it…

Q: Husband and Wife have two biological children and one adopted child. Now that the adoption is…

A: adoption is a process of getting non-biological child of someone else legally.

Q: True or False:

A: Earned Income Tax Credit (EITC) :- The earned income credit (EIC), also called the earned income tax…

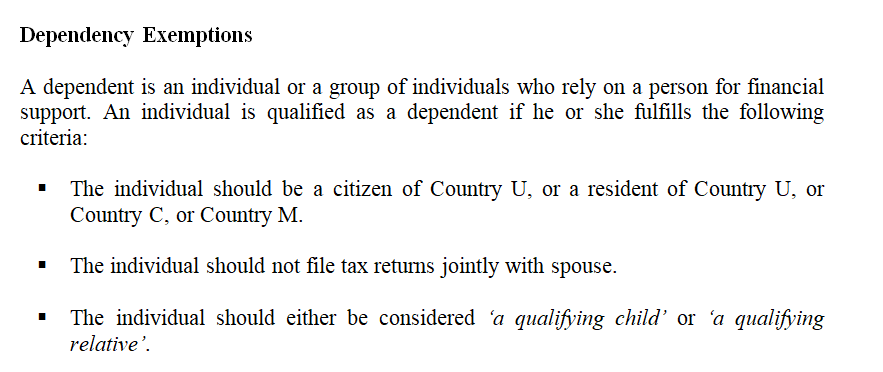

Q: All of the following statements are true except A brother-in-law must live with the taxpayer the…

A: The person doesn't have to live with you in order to qualify as your dependent on taxes.So, it is…

Q: Fails to to provide him with a fixed income for the rest of his life

A: Estate planning states the plan for arranging the allocation of the assets to the beneficiaries as…

Q: Andrew is a successful barrister working in London; he owns his own house. His parents are both…

A: A will is a legal document that allows a person, known as the testator, to make decisions about how…

Q: Marsha is 23 years old and single. She cannot be claimed as a dependent by another taxpayer. •…

A: Taxable income is the amount of income computed to measure the amount of taxes to be paid to the…

Q: Henry wants to establish a trust for his financially challenged adult daughter. He wants to…

A: A trust needs to be established where an annual contribution will be made but the beneficiary will…

Q: Margaret's tax return is prepared, but she does non have the money to pay the amount due. She…

A: The Internal Revenue Service (IRS) is delaying the filing deadline for all individual tax returns…

Q: Vern has a whole life policy, and he has named his wife Corinne as a revocable beneficiary. He is…

A: When Vern designates Corrine as an irrevocable beneficiary of his whole life policy, it means that…

Q: Amy is a creditor of Bia. In order to escape the liability to Amy, Bia sells all his property to…

A: Recission of the contract means unwinding of the transaction, where the payer does a transaction to…

Q: Neil and Dylan are partners in a lawn mower repair business in Ohio. While Neil is on vacation…

A: As the work performed for his sister's neighbor is similar to the work which is usually performed by…

Q: Joey lives in North Carolina, a common law state. He is a shareholder in an S corporation. If he…

A: S corporations are ordinary business corporationst that elect to pass corporate income, losses,…

Q: Old Age Security (OAS) differs from the CPP in many ways. Which of the following statements does…

A: Old age security (OAS) and Canada Pension Plan (CPP) both are old age pension plans. CPP is not a…

Q: Pedro Viera and Valeria Real are married, filing a joint return, and have two dependent children…

A: “Since you have posted a question with multiple sub parts, we will provide the solution only to the…

Q: Ned is an independent contractor working with Joe remodeling a home, and Joe pays him using…

A: The objective of the question is to understand how to report income received in the form of…

Q: Connor is considering investing in a real estate partnership. Exact detail are still unknow, but…

A: Investment in Real estate partnership is no doubt a lucrative options for the investors but along…

Q: kara is ordained minister and church provides her housing allowance which she spends to rent her…

A: It is a problem statement that wants to identify the tax treatment of housing allowance given by the…

Q: a. What is the Comers' tax liability for 2023 if they report the following capital gains and losses…

A: Income tax is compulsory for all taxpayers. However, incomes from different sources are taxed at…

Q: the hernandez seem to receive most of their income from employment rather than investments what…

A: Investment refers to the asset or the item which is acquired with the objective of generating the…

Q: Although Margaret's tax return has been prepared, she is unable to pay the balance owed. She ought

A: The Internal Revenue Service (IRS) is delaying the filing deadline for all individual tax returns…

Q: Cara wants to make sure that her stock portfolio will not have to go through probate when she dies.…

A: Given, In this question, there are some substitutes for Cara to use and we have to choose the better…

Q: Manuel pays insurance premiums for his employees. What type of insurance premium is not deductible…

A: Non deductible insurance premium A individual insurance premium is the kind of insurance premium…

Q: Shauna Coleman is single. She is employed as an architectural designer for Streamline Design (SD).…

A: Adjusted Gross Income (AGI): Adjusted gross income is the amount on which the tax liability of the…

Q: Cadla has a very complex tax return and it looks like she will not be able to file her tax return by…

A: A tax return is a documentation filed with a tax authority that reports income, expenses, and other…

Q: Choose the response that accurately completes the following sentence. Člaiming the Child and…

A: One of the qualifications to the child dependent care credit is: In the case of married taxpayers,…

Q: he couple does not itemize deductions. Other than salary, the Comers’ only other source of income is…

A: Capital Gain/Loss- When an asset is sold for less than its value, it results in a capital loss; when…

Q: Determine whether the individuals will qualify as the taxpayer's dependent in each of the following…

A: Relative is a person connected by blood or marriage. In the context of tax regulations and…

Q: 4. Ned is single and lives alone. He covers all of the household expenses of his mother Barbara…

A: Head of Household If a Resident or a taxpayer pays more than half the cost of keeping up his own…

Q: Rosina can withdraw from her Registered Retirement Savings Plan (RRSP) with no tax impact but if she…

A: Explanation : Registered Retirement Income Fund (RRIF) is account registered with government that…

Q: Under intestacy laws, if Darlene has no heirs, then the property of her estate a. is held in…

A: Intestacy laws is a law of succession of property

her husband didn’t have any income, can i add him as a dependent ?

Step by step

Solved in 3 steps with 3 images

- M10.Lewis, age 26, and Oneida, age 25, are married and will file a joint return. They cannot be claimed as dependents by another taxpayer. Lewis and Oneida have no children or other dependents. Both work and neither are full-time students. Lewis earned wages of $10,400 and Oneida earned wages of $5,600. Lewis and Oneida are U.S. citizens and have valid Social Security numbers. Lewis and Oneida have investment income of $5,000. 3. Lewis and Oneida are eligible to claim the Earned Income Tax Credit (EITC) without a qualifying child. Sebastian and Ashley Miller are married and always file Married Filing Jointly. Sebastian earned $32,000 in wages and Ashley earned $24,000 in wages. The Millers paid all the cost of keeping up a home and provided all the support for their two children, Laura and Timothy, who lived with them all year. Laura is 14 years old and Timothy turned 17 in November 2022. Sebastian and Ashley did not have enough deductions to itemize,…Exactly who can be a “qualifying relative” and who can’t…??? Say, for example, that you are unmarried but have a “friend” who lives with you full-time / all year. It’s just the two of you (and maybe a quadruped or two). The apartment (or house) is in your name only and you pay all of the rent (or mort-gage) and for absolutely everything else because your friend is a “writer” who does nothing by way of work other than on a supposed novel – which of course brings in absolutely zero income because it never seems to get finished, much less published… Since you’re the sole breadwinner and it’s your apartment (or house), can you file as “Head of household” instead of as “Single”? Explain in 2-3 sentences.

- In connection with the application of the kiddie tax, comment on the following. A. The child has only earned income . B. The child has a modest amount of unearned income. C. The child is age 20, is not a student, and is not disabled. D. The child is married E. Effect of the parental election. F. The result when the parental election is made and the married parents file separate returns.Should this be option D? Hasn't she reduced her estate by gifting shares to her three children?Tom Brown is 36 years old and has never been married. Frank, age 13, is Tom1s nephew who lived with hin all year. Tom provided all of his support and provifded over half the cost of keeping up the home. Tom earned 44,000 in wages Tom is legally blind and cannot be claiment as a dependent by another taxpayer. Tom and Frank are U.S citizens, have valid social securities numbers, and lived in the U.S. the entire year. Do the individual income tax return? If need to use a state use mississippi

- Please dont use any AI. It's strictly prohibited. Help me please asap.Which one of the following statements describes the consequences of using the filing status 'married filing jointly'? A spouse may not be held responsible for tax if that spouse had no income. The tax rates are generally more favorable than that of two single individuals if one has high income and the other has low income. If it is elected on an original return, it may be changed on an amended return.Help me please asap. Don't use AI. It's strictly prohibited.

- Which statement describes a technique used to address the issue of ensuring the payment of adequate child support by a noncustodial parent when the parents of minor children are divorced? A) A provision in the noncustodial parent's will leaving property to the minor will solve this concern. B) To ensure that child support payments are continued if the noncustodial parent dies or becomes disabled before such payments are to cease, the parents must enter into a nuptial agreement. C) An irrevocable trust established and funded by the noncustodial parent to ensure payment of child support can be a valuable tool to protect such assets from the claims of future creditors of the noncustodial parent. D) Insurance on the life of the noncustodial parent must be owned by an irrevocable life insurance trust to prevent the noncustodial parent from changing the beneficiary.Please help me. Thankyou.1. Ronald is 92 years old and in poor health. Clever investing earlier in his life has left him with a sizeable income. He is able to support his son Ed. Ed is 67 years old and a bit "confused," so he lives in a nursing home. Ed's income is less than $2,000. How many dependents should Ronald claim on his tax return? a.2 b.3 c.1 d.0 e.None of these choices are correct. 2. Which of the following relatives will not satisfy the relationship test for the dependency? a.Sister b.Parent c.Adopted child d.Aunt e.All of these choices satisfy the test. 3. Your standard deduction will be $12,550 in 2021 if you are: a.Single, 27 years old, and blind. b.Single and 67 years old. c.Single and 45 years old. d.A nonresident alien. e.A married individual filing a separate return and your spouse itemizes his deductions.