How would I prepare this balance sheet? I've included the trial balance and below is the statement of stockholder equity: Common Stock Retained Earnings Total Beginning Balances, September 30 0 0 0 Issued Common Stock 30,000.00 30,000.00 Net Income 32281.67 32,281.67 Dividends (10,000.00) (10,000.00) Ending Balances, December 31: 30,000.00 22,281.67 52,281.67

How would I prepare this balance sheet? I've included the trial balance and below is the statement of stockholder equity: Common Stock Retained Earnings Total Beginning Balances, September 30 0 0 0 Issued Common Stock 30,000.00 30,000.00 Net Income 32281.67 32,281.67 Dividends (10,000.00) (10,000.00) Ending Balances, December 31: 30,000.00 22,281.67 52,281.67

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

How would I prepare this

| Common Stock | Total | ||

| Beginning Balances, September 30 | 0 | 0 | 0 |

| Issued Common Stock | 30,000.00 | 30,000.00 | |

| Net Income | 32281.67 | 32,281.67 | |

| Dividends | (10,000.00) | (10,000.00) | |

| Ending Balances, December 31: | 30,000.00 | 22,281.67 | 52,281.67 |

Transcribed Image Text:A Company

Trial

Balance

20xx

Unadjusted trial balance

Adjusting entries

Adjusted trial balance

Account

Debit

Credit

Debit

Credit

Debit

Credit

Cash

51,436.75

20,500.00

51,436.75

Baking Supplies

19,400.00

1,100.00

Merchandise Inventory

175.65

175.65

Prepaid Rent

1,500.00

1,200.00

1,500.00

Prepaid Insurance

200.00

1,000.00

Baking Equipment

Accumulated Depreciation

Office Supplies

5,000.00

5,000.00

208.33

208.33

600.00

550.00

50.00

Accounts Receivable

9,700.00

9,700.00

Notes Payable

Interest Payable

Accounts Payable

Wages Payable

10,000.00

10,000.00

150.00

150.00

7,000.00

7,000.00

480.00

480.00

Common Stock

30,000.00

30,000.00

Dividends

10,000.00

10,000.00

Bakery Sales

60,000.00

60,000.00

Merchandise Sales

221.00

221.00

Baking Supplies Expense

Rent Expense

19,400.00

19,400.00

4,500.00

4,500.00

Interest Expense

150.00

150.00

Insurance Expense

200.00

200.00

Depreciation Expense

Misc. Expense

Office Supplies Expense

Business License Expense

Advertising Expense

Wages Expense

Telephone Expense

208.33

208.33

250.00

250.00

550.00

550.00

375.00

375.00

200.00

200.00

1,956.00

1,956.00

150.00

150.00

COGS

157.60

157.60

Total:

107,701.00

107,701.00

20,508.33 20,508.33

108,059.33 108,059.33

Transcribed Image Text:Bakery

Balance Sheet

As of December 31, 2021

Assets

Liabilities and Owners' Equity

Current Assets:

Current Liabilities:

Total Current Liabilities

Long Term Liabilities:

Total Current Assets

Total Long Term Liabilities:

Total Liabilities:

Shareholder's Equity:

Non-Current Assets:

show number ao

negative as the

Total Equity

total formula will

Baking Equipment (Net)

subtract it for you.

Total Assets:

Total Liabilities & Equity

<== Do the debits equal the credits? (they should)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

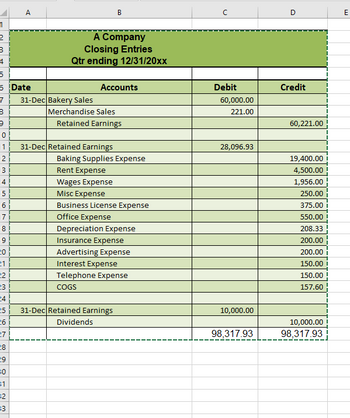

To take this one step further, how would i do the closing and post closing

Transcribed Image Text:1

2

3

4

5

6 Date

7

8

91

600 A WN86 00 OUAWNO

10

1

12₁

13)

14

15

16

17₁

18

19

20

21

22)

23

24

25

26

27

28

29

A

30

31

32

33

A Company

Closing Entries

Qtr ending 12/31/20xx

31-Dec Bakery Sales

Accounts

B

Merchandise Sales

Retained Earnings

31-Dec Retained Earnings

Baking Supplies Expense

Rent Expense

Wages Expense

Misc Expense

Business License Expense

Office Expense

Depreciation Expense

Insurance Expense

Advertising Expense

Interest Expense

Telephone Expense

COGS

31-Dec Retained Earnings

Dividends

с

Debit

60,000.00

221.00

28,096.93

10,000.00

98,317.93

D

Credit

60,221.00

19,400.00

4,500.00

1,956.00

250.00

375.00 i

550.00!

208.33

200.00

200.00 i

150.00 i

150.00

157.60

10,000.00

98,317.93

E

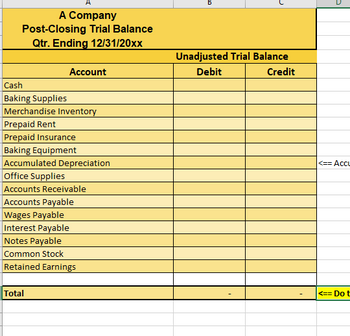

Transcribed Image Text:A Company

Post-Closing Trial Balance

Qtr. Ending 12/31/20xx

Account

Cash

Baking Supplies

Merchandise Inventory

Prepaid Rent

Prepaid Insurance

Baking Equipment

Accumulated Depreciation

Office Supplies

Accounts Receivable

Accounts Payable

Wages Payable

Interest Payable

Notes Payable

Common Stock

Retained Earnings

Total

Unadjusted Trial Balance

Debit

Credit

<== Accu

<== Do t

Solution

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education