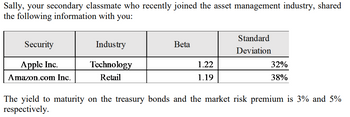

Sally, your secondary classmate who recently joined the asset management industry, shared the following information with you: The yield to maturity on the treasury bonds and the market risk premium is 3% and 5% respectively. Appraise which security (i.e. Apple or Amazon) is more risky, and examine which security(ies) you will include in your investment portfolio. No computations are require, the answer should be in paragraphs

Sally, your secondary classmate who recently joined the asset management industry, shared the following information with you: The yield to maturity on the treasury bonds and the market risk premium is 3% and 5% respectively. Appraise which security (i.e. Apple or Amazon) is more risky, and examine which security(ies) you will include in your investment portfolio. No computations are require, the answer should be in paragraphs and not exceed 400 words.

Step by step

Solved in 3 steps

How to construct a portfolio comprising three assets (i.e. Apple, Amazon and treasury bonds) which produces an expected return of 6% and a beta of 0.6, based on the above information.

Construct a portfolio comprising three assets (i.e. Apple, Amazon and treasury bonds)

which produces an expected return of 6% and a beta of 0.6, based on the above

information.