You currently have two loans outstanding: a car loan and a student loan. The car loan requires that you pay $308 per month, starting next month for 35 more months. Your student loan requires that you pay $132 per month, starting next month for the next 105 months.

A debt consolidation company gives you the following offer: It will pay off the balances of your two loans today and then charge you $455 per month for the next 48 months, starting next month. If your investments earn 3.55% APR, compounded monthly, how much would you save or lose by taking the debt consolidation company’s offer?

If you lose, state your answer with a negative sign (e.g., -25,126)

An Annuity is a series of payments of fixed amounts and at fixed intervals.

These can be of two types:

- Ordinary – payment is made at the end of each period

- Annuity Due – payment is made at the beginning of each period

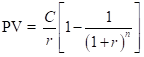

PV of ordinary annuity can be calculated as:

Where C denotes the fixed installment;

r denotes the rate of interest; 3.55% annually or 0.002958 monthly

n denotes number of instalments;

Step by step

Solved in 2 steps with 3 images