Q: A life insurance co. is trying to sell you an investment policy that will pay you and your heirs…

A: Perpetuity refers to a financial concept where a stream of cash flows continues indefinitely. It is…

Q: What annual interest rate wouldyou need to earn if you wanted a$600 per month contribution togrow to…

A: The objective of the question is to find out the annual interest rate required for a monthly…

Q: At what annual interest rate, compounded annually, would $500 have to be invested for it to grow…

A: FV = A * (1+r)nwhereFV = future valueA = amount investedr = interest raten = time period

Q: What is the total interest you will have paid for the scenario below? The home you purchased was…

A: Payment per period can be calculated using PMT function in excel.PMT(rate, nper, pv, [fv],…

Q: You borrow $110,000; the annual loan payments are $16,753.02 for 30 years. What interest rate are…

A: Borrowed amount = $110,000Annual loan payment = $16,753.02Number of years = 30 years

Q: Find the total monthly payment for the mortgage, property tax, and fire insurance. (Round your…

A: Information Provided: Term = 30 years Loan = $193,000 Annual Interest Rate = 7.8% Annual tax bill =…

Q: the discount rate is 7.6%, what would you be willing to pay for receiving a payment of $700 eve

A: Value of any annuity is the present value of cash flow from the annuity based on time and interest…

Q: You borrow $175,000; the annual loan payments are $10,120.27 for 30 years. What interest rate are…

A: Interest on a loan is the additional amount of money that a borrower has to pay back to the lender…

Q: How long will you take to pay a debt of $750,000 using annual interest rate of 10% and annual…

A: According to the time value of money concept, the value of money on the future date will be less…

Q: You borrow $90,000; the annual loan payments are $12,852.25 for 30 years. What interest rate are you…

A: Interest : It is the total amount payment on loan taken or fund borrowed by any person . it may be…

Q: TOTAL INTEREST PAID. You are considering purchasing a home that requires $450,000 mortgage at 5.25%.…

A: Solution:- When an amount is borrowed, it can either be repaid as lump sum payment or in…

Q: You are going to buy a house and borrow $542474 with a 30-year mortgage. Your interest rate is…

A: The future value concept is widely used in finance and economics, including in the areas of…

Q: 6. You purchase a house for $250,000 by getting a mortgage for $200,000 and paying a $50,000 down…

A: Monthly Mortgage Payments Monthly mortgage payment is the repayment of a mortgage loan by paying…

Q: A property has NOI of 1,000,000 and would trade at a cap rate of 5%. You can borrow at a 60% LTV,…

A: The question is based on the concept of debt service coverage ratio (DSCR) for property investment.…

Q: Under what interest rates would you prefer a perpetuity that pays $2 million a year to a one- time…

A: This question require us to compute the interest rate in case of a perpetuity.

Q: What is the effective annual rate on the loan? (i.e., what is the interest rate once we take into…

A: Information Provided: Amount Borrowed = $400,000 Term = 30 years Fixed APR = 3.87%

Q: if a buyer makes a 15% down payment and obtains a $120,000 mortgage what is the sales price of the…

A: if a buyer makes a 15% down payment and obtains a $120000 mortgage. Required What is the sales…

Q: Loan Basics nputs Present value nterest rate/year Number of years 325,000 4.00% 30 Present Value…

A: given, loan amount (P)= $325000 r=4% m=12 n = 30

Q: You have just purchased a new warehouse. To finance the purchase, you've arranged for a 30-year…

A: mortgage value = n = 30 x 12 = 360

Q: If you want to earn 5% annual simple interest on an investment, how much should you pay for a note…

A: The question is based on the concept of time value.

Q: You anticipate an improvement on your property will require replacement in 9 years. How should rent…

A: Cost of improvement of $45,000 is the present value (PV) of the rent (P) to be increased. Interest…

Q: $15,000 is invested for 5 years at an annual simple interest rate of 17%. a) what will you earn in…

A: Interest = Principal * Rate * Time

Q: If a person saves $62 a month by using coupons and doing comparison shopping, (a) what is the amount…

A: Future Value of Ordinary Annuity refers to the concept which determines the sum total of all the…

Q: You have just purchased a new warehouse. To finance the purchase, you've arranged for a 30-year…

A: Mortgage period = 30 yearsPurchase price = $2,700,000Mortgage amount = 80% of purchase priceMonthly…

Q: Suppose you are buying your first home for $144,000, and you have $17,000 for your down payment. You…

A: purchasing price = $144,000 down payment = $17,000 loan amount = $144,000 - 17,000…

Q: If I purchase a home for $150,000. I do a fixed 30-year mortgage at 6%. I have to put down 10% or…

A: Monthly payment = Loan Amount/Annuity factor Annuity factor = (1 - (1+r)^(-n) )/r r = monthly…

Q: The buyers paid $6,125 for a 1 point origination fee and a 1.5 discount point fee, what is the…

A: Origination fee is the amount paid on processing and approving of loan while discount point fee is…

Q: e you want to purchase a home for $475,000 with a 30-year mortgage at 4.34% interest. Suppose also…

A: Mortgage loans are very important in the purchase of home because mortgage make home buying easy and…

Q: is the annual effective rate of interest earned on

A: The effective interest rate is considering effect of the compounding of the interest rate and this…

Q: Suppose you obtain a 30-year mortgage loan of $193,000 at an annual interest rate of 8.6%. The…

A: Mortgage loan is a kind of secured loan, whereby, the lender provides the desired funds to the…

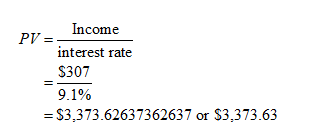

How much should you pay for land that has an income of $307/acre, annually, if the interest rate is 9.1%?

Note: Assuming the land is 1 acre, since no information on the land are is given.

Present value of a regular stream of income of $307/acre for an infinite period at a rate of 9.1%, can be calculated as below:

Step by step

Solved in 2 steps with 1 images

- What's the rate of return you would earn if you paid $950 for a perpetuity that pays $85 per year?Assume that the trip will cost $26,600. What interest rate, compounded annually, must be earned to accumulate enough to pay for the trip?.The purchase price of an acre of land in the Louisiana purchase in 1803 was about 4 cents. Suppose the value of this property grew at an annual rate of 4.9% compounded annually. What would an acre of land be worth in 2020?

- What is the present value of a perpetuity that pays $3,800 per year if the appropriate interest rate is 5%?If you are considering the purchase of a consol that pays $60 per year forever, and the rate of interest you want to earn is 10% per year, how much money should you pay for the consol?You can buy a piece of land today that you except will be worth $15000 in 9 years. Assuming your money is worth 9%, how much would you be willing to pay for the property?

- An investment costs $4,500 and pays $300 in perpetuity. What is the interestearned on this investment?What is the present value of a perpetuity that pays $50 annually and has an annual rate of return of 17%? note: round and show your answer to the nearest dollar.Assume you buy a house for $660,000 and have $132,000 as a down payment. Your mortgage rate is 3 percent APR compounded semi-annually and you amortize the mortgage over 25 years with monthly payments. You will assume that you could have earned 5 percent EAR on the down payment (opportunity cost), your marginal income tax rate is 40 percent, real estate fees are 4 percent +HST and property taxes will be $6,600 annually for this calculation. Ignore maintenance costs. a. What is the true return on your investment if you sell it in 6 years for $1,040,000? (Do not round your intermediate calculations. Round your answer to 2 decimal places. Omit the "%" sign in your response.) Return on Investment % b. What is an approximate annualized rate of return on your investment? (Do not round your intermediate calculations. Round your answer to 3 decimal places. Omit the "%" sign in your response.) Annualized Rate of Return %

- Suppose you buy a home and finance $285,000 at $2,243.17 per month for 30 years. What is the amount of interest paid? (Round your answer to the nearest centIf you put $200,000 into your investment account now for 10 year at 5% annual interest, what is the difference in interest income between simple interest calculation and compound interest calculation? use Excel for calculation.If $476 invested today yields $500 in one year's time, what is the discount rate?