You would like to purchase a vacation home when you retire 9 years from now. The current cost of the homes that interest you is $245,306; however, you expect their price to rise at 2.69% per year for the next 9 years. How much must you save each year in nominal terms (the same amount each year) for 12 years, starting next year, to just be able to pay for the vacation home if you earn 4.56% APR (compounded annually) on your investments?

The worth of today’s dollar at a future date is the future value of the dollar. For example, the value of $ 100 today will not remain the same 10 years later. The value of this $ 100, 10 years later is called as Future Value.

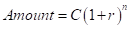

The solution can be found out by simply using the Compounding Interest formula:

Where C denotes the Present amount;

r denotes the rate of interest; 2.69% or 0.0269

n denotes time in years;

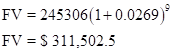

First, calculate the Value of the house 9 years from now:

Step by step

Solved in 2 steps with 4 images