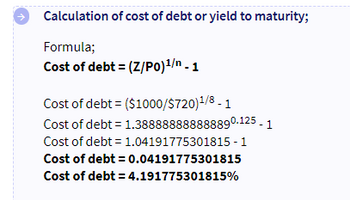

"Heart Limited has one bond in issue expiring in eight years, paying 0 coupon and has a face value of $1000. It is currently traded at $720, Beta =1.2, risk free rate is 2%, historic market risk premium is 5.5%. Assume the ratio of debt to equity is 2:1, and corporate tax rate is 20%." (c) Determine the WACC for Heart Limited.

"Heart Limited has one bond in issue expiring in eight years, paying 0 coupon and has a face value of $1000. It is currently traded at $720, Beta =1.2, risk free rate is 2%, historic market risk premium is 5.5%. Assume the ratio of debt to equity is 2:1, and corporate tax rate is 20%."

(c) Determine the WACC for Heart Limited.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Hi, how do you derive to this formula? please enlighten, thankyou

Suppose Jack, president of Heart Limited has hired you to advise on the firm’s cost of capital.

(a) Based on the most recent financial statements, Heart’s total liabilities are $8 million. Total interest expense for the coming year will be about $1 million. Jack therefore reasons, “We owe $8 million, and we will pay $1 million interest. Therefore, our cost of debt is obviously $1 million/8 million = 12.5%.” Appraise Jack’s statement.

(b) The company paid $1 million of dividends in the past year. Its market capitalization was $10 million. Based on his own analysis, Jack suggests that the company increases its use of equity financing, because “debt costs 12.5 percent, but equity only costs 10 percent; thus, equity is cheaper.” Appraise Jack’s statement.