Housing prices have been increasing in much of the U.S. For most people, their home is their single largest asset. Show with whichever model(s) may be helpful and explain how an increase in housing prices could affect the U.S. economy in the short and long runs.

Housing

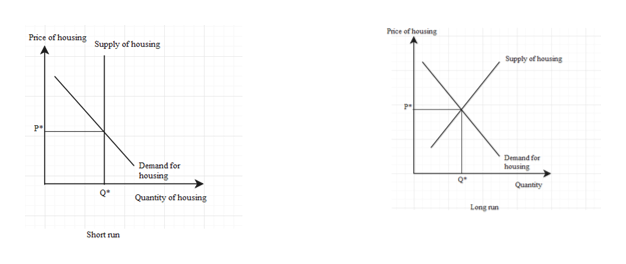

It is given that housing prices are increasing in US. Let us first discuss the determination of housing prices in short run and long run.

Short run: In short run, the demand for housing is downward sloping since at a higher price, the demand for house would be lower and vice-versa. On the other hand, the supply of housing would be fixed in the short run.

Long run: In long run, the demand for housing is downward sloping. However, in the long run, the supply of housing becomes positively sloped.

The determination of price of housing is shown in the diagram below:

An increase in price of housing has multi-faceted effects on the economy.

To start with, we can say that since house is the single most expensive asset possessed by a consumer, rising price of houses would cause an increase in wealth of homeowners. The wealth effect would cause consumer spending to increase in the short run. This would, in effect, accelerate economic growth.

On the other hand, rising prices of houses would encourage homeowners to take on mortgages of higher values. This would further boost aggregate spending.

Step by step

Solved in 3 steps with 1 images