Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for Omega Corporation. Unfortunately, although the data for the individual items are correct, he is very confused as to whether an item should go in the balance sheet or income statement and whether it is an asset or liability. BALANCE SHEET Payables $ 44 Inventories $ 59 Less accumulated depreciation 129 Receivables 80 Total current assets Total current liabilities Long-term debt $ 395 Interest expense $ 34 Property, plant, and equipment 565 Total liabilities Net fixed assets Shareholders’ equity $ 126 Total assets Total liabilities and shareholders’ equity INCOME STATEMENT Net sales $ 790 Cost of goods sold 625 Selling, general, and administrative expenses 47 EBIT Debt due for repayment $ 34 Cash 24 Taxable income Federal plus other taxes $ 24 Depreciation 21 Net income Prepare the balance sheet and income statement by rearranging the above items.

Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for Omega Corporation. Unfortunately, although the data for the individual items are correct, he is very confused as to whether an item should go in the balance sheet or income statement and whether it is an asset or liability. BALANCE SHEET Payables $ 44 Inventories $ 59 Less accumulated depreciation 129 Receivables 80 Total current assets Total current liabilities Long-term debt $ 395 Interest expense $ 34 Property, plant, and equipment 565 Total liabilities Net fixed assets Shareholders’ equity $ 126 Total assets Total liabilities and shareholders’ equity INCOME STATEMENT Net sales $ 790 Cost of goods sold 625 Selling, general, and administrative expenses 47 EBIT Debt due for repayment $ 34 Cash 24 Taxable income Federal plus other taxes $ 24 Depreciation 21 Net income Prepare the balance sheet and income statement by rearranging the above items.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Henry Josstick has just started his first accounting course and has prepared the following

| BALANCE SHEET | |||

| Payables | $ 44 | Inventories | $ 59 |

| Less accumulated |

129 | Receivables | 80 |

| Total current assets | Total current liabilities | ||

| Long-term debt | $ 395 | Interest expense | $ 34 |

| Property, plant, and equipment | 565 | Total liabilities | |

| Net fixed assets | Shareholders’ equity | $ 126 | |

| Total assets | Total liabilities and shareholders’ equity |

| INCOME STATEMENT | |

| Net sales | $ 790 |

|---|---|

| Cost of goods sold | 625 |

| Selling, general, and administrative expenses | 47 |

| EBIT | |

| Debt due for repayment | $ 34 |

| Cash | 24 |

| Taxable income | |

| Federal plus other taxes | $ 24 |

| Depreciation | 21 |

| Net income |

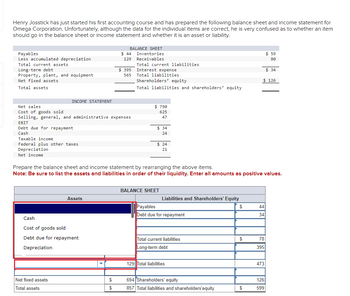

Prepare the balance sheet and income statement by rearranging the above items.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

One of the answers in the

Transcribed Image Text:Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for

Omega Corporation. Unfortunately, although the data for the individual items are correct, he is very confused as to whether an item

should go in the balance sheet or income statement and whether it is an asset or liability.

Payables

Less accumulated depreciation

Total current assets

Long-term debt

Property, plant, and equipment

Net fixed assets

Total assets

EBIT

Debt due for repayment

Cash

INCOME STATEMENT

Net sales

Cost of goods sold

Selling, general, and administrative expenses

Taxable income

Federal plus other taxes

Depreciation

Net income

--------------…………………………………

Cash

Cost of goods sold

Debt due for repayment

Depreciation

Net fixed assets

Total assets

Assets

BALANCE SHEET

$44 Inventories

129

Receivables

$395

565

$

$

Total current liabilities

Interest expense

Total liabilities

Shareholders' equity

Total liabilities and shareholders' equity

$ 790

625

47

Prepare the balance sheet and income statement by rearranging the above items.

Note: Be sure to list the assets and liabilities in order of their liquidity. Enter all amounts as positive values.

$34

24

$24

21

BALANCE SHEET

Liabilities and Shareholders' Equity

$

Payables

Debt due for repayment

Total current liabilities

Long-term debt

129 Total liabilities

694 Shareholders' equity

857 Total liabilities and shareholders'equity

$

$

$ 34

$ 126

44

34

78

395

$59

80

473

126

599

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education