Harris Corporation Stockholders’ Equity December 31, 2022 Common Stock ($1 par, 100,000 authorized, 50,000 issued & outstanding)$ 50,000 Additional Paid-in-Capital 150,000 Retained Earnings 500,000 Total Stockholders’ Equity$ 700,000 ==== • On March 1, 2023, the company issued an additional 5,000 shares of common stock for $25 per share. • On April 1, 2023, the company declared a 10% stock dividend, payable on May 15th, when the market value was $30 per share. • On August 1, 2023, the company declared a 60% stock dividend, payable on September 15th, when the market value was $40 per share. • On November 1, 2023, the company repurchased 10,000 of its shares for $35 per share. • Net income for 2023 was $400,000. • A $0.50 per share cash dividend was declared on December 20, 2023, payable February 1, 2024. Using the cost method to account for treasury stock, prepare all necessary 2023 journal entries and prepare the stockholders’ equity section of the December 31, 2023, balance sheet.

Harris Corporation

December 31, 2022

Common Stock ($1 par, 100,000 authorized, 50,000 issued & outstanding)$ 50,000

Additional Paid-in-Capital 150,000

Total Stockholders’ Equity$ 700,000

====

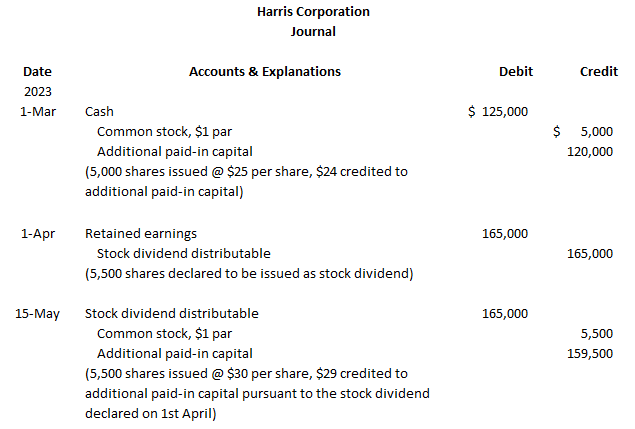

• On March 1, 2023, the company issued an additional 5,000 shares of common stock for $25 per share.

• On April 1, 2023, the company declared a 10% stock dividend, payable on May 15th, when the market value was $30 per share.

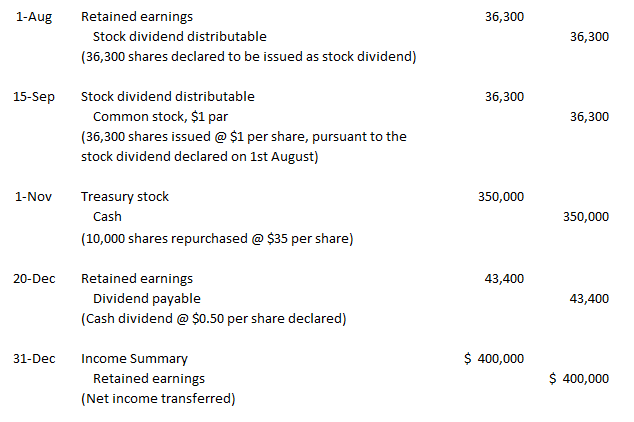

• On August 1, 2023, the company declared a 60% stock dividend, payable on September 15th, when the market value was $40 per share.

• On November 1, 2023, the company repurchased 10,000 of its shares for $35 per share.

• Net income for 2023 was $400,000.

• A $0.50 per share cash dividend was declared on December 20, 2023, payable February 1, 2024.

Using the cost method to account for

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images