Variable Name Term deposit Age Job Marital Education Default: has credit in default? Housing Loan Contact Month Day_of_week Duration Campaign Pdays Previous Ethnicity Poutcome Emp.var.rate Cons.price.idx Cons.conf.idx Euribor (3m) Nr.employed: Description of the Dataset Description Has the client subscribed a term deposit? 1 if yes, 0 if no. Age of Customer in Years Job Status Marital Status Level of education Default Status Has availed Housing Loan? Has availed Personal Loan? Contact communication type Last contact month of year Last contact day of the week Last contact duration, in seconds # of contacts performed during this campaign and for this client (includes last contact) # of days that passed by after the client was last contacted from a previous campaign (999 means client was not previously contacted) # of contacts performed before this campaign and for this client Caucasian is the reference ethnic category; Ethnicity African: Is the customer of African ethnicity? 1=Yes, 0=No; Outcome of the previous marketing campaign Employment variation rate: quarterly indicator Consumer price index: monthly indicator Consumer confidence index: monthly indicator Euribor 3 month rate # of employees: quarterly indicator Category Binary ('1', '0') Numeric Categorical Categorical Categorical Categorical Categorical Categorical Categorical Categorical Categorical Numeric Numeric Numeric Numeric Numeric Categorical Numeric Numeric Numeric Numeric Numeric Duration: last contact duration, in seconds (numeric). Important note: this attribute highly affects the output target (e.g., if duration=0 then Term Deposit='0'). Yet, the duration is not known before a call is performed. Also, after the end of the call Term Deposit is clearly known. Thus, this input should only be included for benchmark purposes and should be discarded if the intention is to have a realistic predictive model.

Variable Name Term deposit Age Job Marital Education Default: has credit in default? Housing Loan Contact Month Day_of_week Duration Campaign Pdays Previous Ethnicity Poutcome Emp.var.rate Cons.price.idx Cons.conf.idx Euribor (3m) Nr.employed: Description of the Dataset Description Has the client subscribed a term deposit? 1 if yes, 0 if no. Age of Customer in Years Job Status Marital Status Level of education Default Status Has availed Housing Loan? Has availed Personal Loan? Contact communication type Last contact month of year Last contact day of the week Last contact duration, in seconds # of contacts performed during this campaign and for this client (includes last contact) # of days that passed by after the client was last contacted from a previous campaign (999 means client was not previously contacted) # of contacts performed before this campaign and for this client Caucasian is the reference ethnic category; Ethnicity African: Is the customer of African ethnicity? 1=Yes, 0=No; Outcome of the previous marketing campaign Employment variation rate: quarterly indicator Consumer price index: monthly indicator Consumer confidence index: monthly indicator Euribor 3 month rate # of employees: quarterly indicator Category Binary ('1', '0') Numeric Categorical Categorical Categorical Categorical Categorical Categorical Categorical Categorical Categorical Numeric Numeric Numeric Numeric Numeric Categorical Numeric Numeric Numeric Numeric Numeric Duration: last contact duration, in seconds (numeric). Important note: this attribute highly affects the output target (e.g., if duration=0 then Term Deposit='0'). Yet, the duration is not known before a call is performed. Also, after the end of the call Term Deposit is clearly known. Thus, this input should only be included for benchmark purposes and should be discarded if the intention is to have a realistic predictive model.

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:Variable Name

Term deposit

Age

Job

Marital

Education

Default: has credit in default?

Housing

Loan

Contact

Month

Day_of_week

Duration

Campaign

Pdays

Previous

Ethnicity

Poutcome

Emp.var.rate

Cons.price.idx

Cons.conf.idx

Euribor (3m)

Nr.employed:

Description of the Dataset

Description

Has the client subscribed a term deposit? 1 if

yes, 0 if no.

Age of Customer in Years

Job Status

Marital Status

Level of education

Default Status

Has availed Housing Loan?

Has availed Personal Loan?

Contact communication type

Last contact month of year

Last contact day of the week

Last contact duration, in seconds

# of contacts performed during this campaign

and for this client (includes last contact)

# of days that passed by after the client was last

contacted from a previous campaign (999 means

client was not previously contacted)

# of contacts performed before this campaign

and for this client

Caucasian is the reference ethnic category;

Ethnicity African: Is

the customer of African ethnicity? 1=Yes, 0=No;

Outcome of the previous marketing campaign

Employment variation rate: quarterly indicator

Consumer price index: monthly indicator

Consumer confidence index: monthly indicator

Euribor 3 month rate

# of employees: quarterly indicator

Category

Binary ('1', '0')

Numeric

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Numeric

Numeric

Numeric

Numeric

Numeric

Categorical

Numeric

Numeric

Numeric

Numeric

Numeric

Duration: last contact duration, in seconds (numeric). Important note: this attribute highly affects the output target

(e.g., if duration=0 then Term Deposit='0'). Yet, the duration is not known before a call is performed. Also, after

the end of the call Term Deposit is clearly known. Thus, this input should only be included for benchmark purposes

and should be discarded if the intention is to have a realistic predictive model.

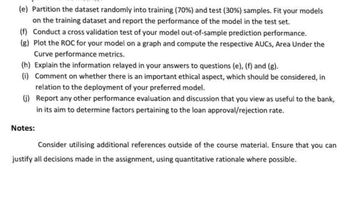

Transcribed Image Text:(e) Partition the dataset randomly into training (70%) and test (30%) samples. Fit your models

on the training dataset and report the performance of the model in the test set.

(f) Conduct a cross validation test of your model out-of-sample prediction performance.

(g) Plot the ROC for your model on a graph and compute the respective AUCs, Area Under the

Curve performance metrics.

(h) Explain the information relayed in your answers to questions (e), (f) and (g).

(i) Comment on whether there is an important ethical aspect, which should be considered, in

relation to the deployment of your preferred model.

(j)

Report any other performance evaluation and discussion that you view as useful to the bank,

in its aim to determine factors pertaining to the loan approval/rejection rate.

Notes:

Consider utilising additional references outside of the course material. Ensure that you can

justify all decisions made in the assignment, using quantitative rationale where possible.

Expert Solution

Step by step

Solved in 10 steps with 8 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

In this image I just want the answers for h,I and J. Thanks in advance.

Transcribed Image Text:(e) Partition the dataset randomly into training (70%) and test (30%) samples. Fit your models

on the training dataset and report the performance of the model in the test set.

(f) Conduct a cross validation test of your model out-of-sample prediction performance.

(g) Plot the ROC for your model on a graph and compute the respective AUCs, Area Under the

Curve performance metrics.

(h) Explain the information relayed in your answers to questions (e), (f) and (g).

(i) Comment on whether there is an important ethical aspect, which should be considered, in

relation to the deployment of your preferred model.

(j)

Report any other performance evaluation and discussion that you view as useful to the bank,

in its aim to determine factors pertaining to the loan approval/rejection rate.

Notes:

Consider utilising additional references outside of the course material. Ensure that you can

justify all decisions made in the assignment, using quantitative rationale where possible.

Transcribed Image Text:Variable Name

Term deposit

Age

Job

Marital

Education

Default: has credit in default?

Housing

Loan

Contact

Month

Day_of_week

Duration

Campaign

Pdays

Previous

Ethnicity

Poutcome

Emp.var.rate

Cons.price.idx

Cons.conf.idx

Euribor (3m)

Nr.employed:

Description of the Dataset

Description

Has the client subscribed a term deposit? 1 if

yes, 0 if no.

Age of Customer in Years

Job Status

Marital Status

Level of education

Default Status

Has availed Housing Loan?

Has availed Personal Loan?

Contact communication type

Last contact month of year

Last contact day of the week

Last contact duration, in seconds

# of contacts performed during this campaign

and for this client (includes last contact)

# of days that passed by after the client was last

contacted from a previous campaign (999 means

client was not previously contacted)

# of contacts performed before this campaign

and for this client

Caucasian is the reference ethnic category;

Ethnicity African: Is

the customer of African ethnicity? 1=Yes, 0=No;

Outcome of the previous marketing campaign

Employment variation rate: quarterly indicator

Consumer price index: monthly indicator

Consumer confidence index: monthly indicator

Euribor 3 month rate

# of employees: quarterly indicator

Category

Binary ('1', '0')

Numeric

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Categorical

Numeric

Numeric

Numeric

Numeric

Numeric

Categorical

Numeric

Numeric

Numeric

Numeric

Numeric

Duration: last contact duration, in seconds (numeric). Important note: this attribute highly affects the output target

(e.g., if duration=0 then Term Deposit='0'). Yet, the duration is not known before a call is performed. Also, after

the end of the call Term Deposit is clearly known. Thus, this input should only be included for benchmark purposes

and should be discarded if the intention is to have a realistic predictive model.

Solution

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman